The price of Bitcoin has been struggling lately because the market sentiment isn’t great. Let’s break down what’s happening with BTC and why things look a bit gloomy.

A Tough Spot for Bitcoin

If you’ve been watching Bitcoin’s 1-hour chart, you’ve probably noticed that BTC is stuck at $56,700. It’s caught between the 20 day & 50 day moving averages, kind of like being stuck in a traffic jam.

The price started dropping from $64,000 and found some support at $53,800. But every time it tries to climb back up, it gets pushed down again by the 50-day moving average at $57,000. Even with some support at the $56,000 level, it’s not giving us much hope.

Rising Wedge Giving Warning

Right now, the chart shows a rising wedge pattern. This usually isn’t good news. It’s like BTC is trying to climb a slippery hill, and for the past four hours, all the hourly candles have been dojis—small moves that show the market is unsure. This means even a little bit of bad news could push BTC lower, leading to more drops in price.

More Bad News

If we check the weekly chart, we see another bad sign there – The double top or “M” pattern. This often signals a big reversal after an uptrend, adding fuel to the negative feeling.

Never Ending Bearish Signs

The MACD indicator is also showing negative signs. It’s another clue that the bears are in control. The MACD line tried to cross the signal line, however failed.

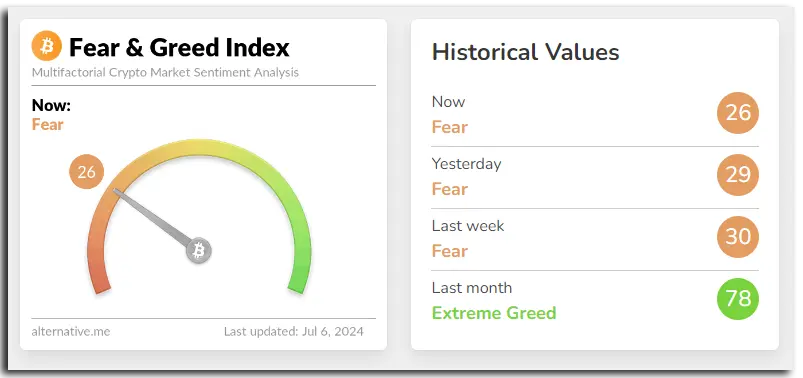

On the other hand, the Fear & Greed Index has also dropped 3 points to 26, showing that fear is increasing in the market compared to yesterday.

BTC Might be Going to Bears

If the bears keep pushing, Bitcoin’s price could drop all the way down to $48,500. The current patterns and indicators all point to a tough time ahead for BTC.

Bitcoin’s price is currently struggling. A combination of negative patterns are visible on the chart. Patterns such as the rising wedge and double top, along with negative indicators like the MACD and a decreasing Fear & Greed Index, suggest that sellers are dominating the market. Traders and investors should be cautious, as the market might experience further declines if the negative sentiment persists. However, it can also be an opportunity for some people.

Credit: Source link