manassanant pamai

By Ewa Manthey, Commodities Strategist

Fed policy remains key for gold

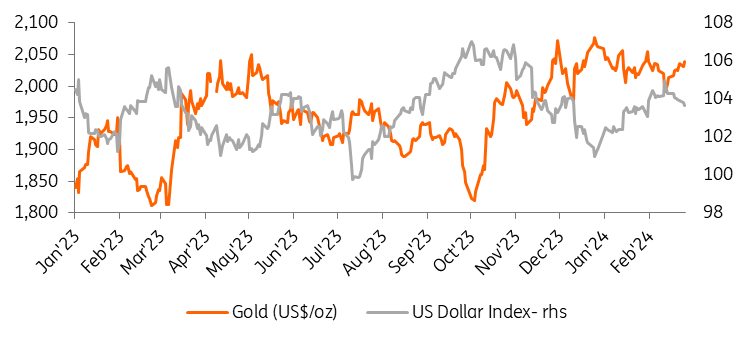

Federal Reserve policy will remain key for the outlook of gold prices in the months ahead. US dollar strength and central bank tightening weighed on the gold market for most of last year.

Swaps markets suggest investors don’t see much chance of a reduction in interest rates until June. Our US economist agrees. This will support the dollar and weigh on the gold price in the short term. We expect gold prices to remain volatile in the coming months as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.

Safe haven demand supports gold

Source: Refinitiv, ING Research

Gold still shines on safe-haven demand

Gold prices have held above the key $2,000/oz level since December, with the precious metal being supported by safe-haven demand amid geopolitical tensions. Ongoing geopolitical risks in Ukraine and the Middle East continue to provide support to gold. Prices hit an all-time high of $2,077.49/oz on 27 December 2023. Still, we believe the Federal Reserve’s wait-and-see approach will keep the rally in check. We expect prices to average $2,025/oz over the first quarter.

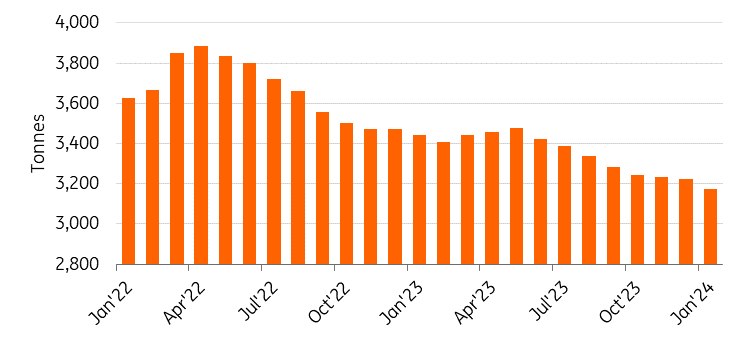

ETF holdings continue to fall

However, investment demand for gold is yet to rebound. Total holdings in bullion-backed ETFs have continued to decline. January saw eight monthly outflows in global gold ETFs, led by North American funds. This was equivalent to a 51-tonne reduction in global holdings to 3,175 tonnes by the end of January, as shown by data from the World Gold Council. This trend has continued in February.

With the bets on early rate cuts from major central banks being pushed back, investors’ interest in gold ETFs faded with investors seeking returns in other assets.

Investors’s interest in gold ETFs fades

Source: WGC, ING Research

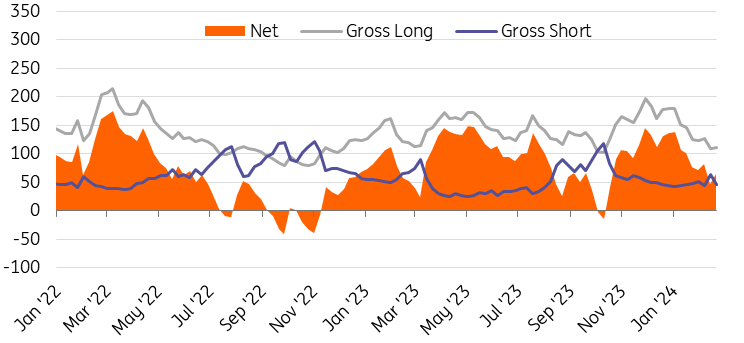

Investors shun gold

Source: CFTC, WGC, ING Research

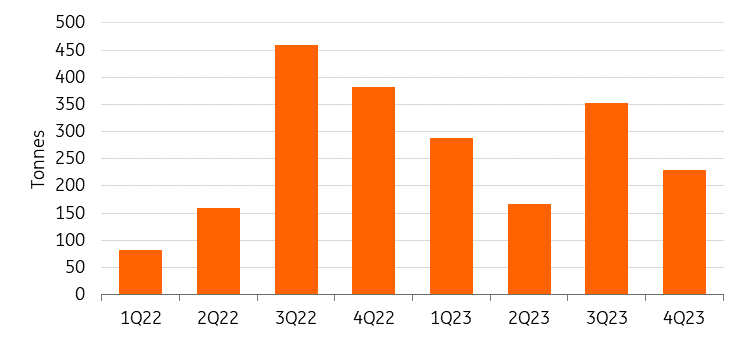

China leads central bank buying

However, strong central bank buying has helped to offset ETF outflows. Central bank demand maintained its momentum in the fourth quarter with a further 229 tonnes added to global official gold reserves, as shown by data from the World Gold Council. This lifted annual net demand to 1,037 tonnes – just short of the record set in 2022 of 1,082 tonnes – as reserve diversification and geopolitical concerns pushed central banks to increase their allocation towards safe assets. The People’s Bank of China and the National Bank of Poland were the driving forces.

Gold tends to become more attractive in times of instability and demand has been surging over the past two years. We believe this is likely to continue this year amid geopolitical tensions and the current economic climate.

Central banks increase allocations toward safe-haven assets

Source: WGC, ING Research

We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with ongoing wars and the upcoming US election. We forecast prices to average $2,150/oz in the fourth quarter and $2,081/oz in 2024 on the assumption that the Fed starts cutting rates in the second quarter of the year and the dollar weakens. Downside risks revolve around US monetary policy and dollar strength. The higher-for-longer narrative could see a stronger dollar for longer and weaker gold prices.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Credit: Source link