As of 5:30 PM EDT, gold futures basis the most active June contract is once again trading at a new record high of $2349.10. The June contract of Comex gold opened today at $2309.50, traded to a low of $2286.20 and a high of $2350 before settling just $0.90 off today’s intraday high.

It seems as though gold has entered a perfect storm scenario in which multiple factors are contributing to gold’s historic rise. Gold analysts worldwide, including myself are re-evaluating and upgrading gold’s forecast for 2024. Originally, my gold outlook 2024 anticipated gold prices moving between $2250 to $2300 per ounce. Obviously, with gold futures hitting $2350 today that forecast seems to be tepid at best.

Three primary forces are moving gold prices beyond expectations. Central bank demand, upcoming interest rate cuts by the Federal Reserve and other central banks worldwide, and lastly exceedingly strong geopolitical tensions on multiple fronts including the Middle East and the Ukraine-Russian conflict.

MarketWatch quoted an emailed commentary by Nigel Green, chief executive officer at deVere Group, where he wrote, “The surge in gold prices to unprecedented levels has captured the attention of investors worldwide.”

Elaborating on this topic, he said, “common narrative attributes this surge to geopolitical tensions and expectations of interest-rate cuts by the U.S. Federal Reserve… It’s certainly true that the Russia-Ukraine war and conflicts in the Middle East have contributed to the uncertainty plaguing global markets… and investors traditionally flock to gold during times of geopolitical turmoil — perceiving it as a “safe-haven asset that retains value even in turbulent times.”

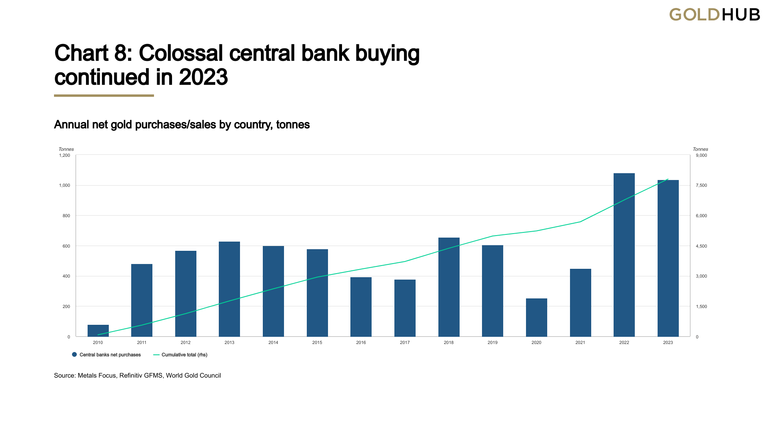

The chart above from the World Gold Council clearly illustrates that central bank demand has been a key driver of gold prices over the last couple of years. More so, central bank purchases in 2022 and 2023 have dwarfed previous years in accumulating the precious yellow metal and adding it to their reserves. In just the last two years central banks have added over 1000 tonnes and have now stockpiled over 15,000 tonnes.

According to the WGC, “Central banks have been consistent net buyers on an annual basis since 2010, accumulating over 7,800t in that time, of which more than a quarter was bought in the last two years. Findings from our 2022 and 2023 Central Bank Gold Survey show that gold’s performance during times of crisis and its role as a long-term store of value are key reasons for central banks to hold gold.”

The WGC that, “The People’s Bank of China (PBoC) regained the crown for the largest single gold buyer; as it reported a total rise of 225t in its gold reserves over the year. As

a result, PBoC gold reserves now stand at 2,235t, although this still represents only 4% of China’s vast international reserves.”

The report also indicated that “The National Bank of Poland was the second largest buyer in 2023. Between April and November, the central bank bought 130t of gold, increasing its gold holdings by 57%, to 359t.”

Central bank purchases are only one of the three key drivers of the unprecedented rise in gold prices recently. A major concern is a dramatic uptick in geopolitical concern regarding the Middle East conflict as the real concern is that Iran will retaliate against Israel for its suspected bombing of the Embassy in Syria. Lastly, most analysts agree that gold will move higher once central banks, including the Federal Reserve begin the process of cutting their key benchmark interest rates.

Collectively, these three key driving factors taking gold higher will continue to move the precious yellow metal higher into what is now unknown price territory.

For those who wish to learn more about our service, please go to the links below: Information, Track Record, Trading system, Testimonials, Free trial

Wishing you as always good trading,

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link