Demand for gold is high, with Costco reportedly selling up to $200 million worth of gold bars every month in the United States.Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

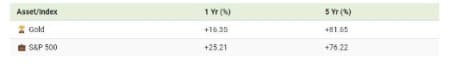

To put this into perspective, Visual Capitalist’s Marcus Lu visualized the performance of gold alongside the S&P 500.

See the table below for performance figures as of April 12, 2024.

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

By Zerohedge.com

More Top Reads From Oilprice.com:

Read this article on OilPrice.com

Credit: Source link