The number of homes selling in Calgary for more than $1 million have shot up 46%

Article content

High immigration and interprovincial migration are having a profound impact on luxury housing in four of Canada’s biggest cities, a new report found.

Sotheby’s International Realty Canada released its mid-year state of luxury real estate report, which found the Calgary market to be booming along with its population. In major cities where population growth has stalled – Toronto, Vancouver and Montreal – the market is more subdued.

Advertisement 2

Article content

The report found Calgary’s six per cent population growth “exerted unprecedented pressure” on its housing supply. The number of homes selling for more than $1 million in the city grew by 46 per cent in the first half of 2024, while homes selling for more than $4 million climbed by 75 per cent.

Calgary also led the way when it came to interregional migration, having welcomed 26,662 new people from other parts of Canada, while Toronto (-93,024), Montreal (-20,624) and Vancouver (-18,399) each experienced net losses.

“While record-setting population gains in Canada’s largest metropolitan areas continue to be powerful influences on the local real estate market, interprovincial and interregional migration patterns are now leading signals for local economic sentiment, core housing demand, and conventional and luxury real estate market performance overall,” Don Kottick, chief executive of Sotheby’s International Realty Canada, said in a news release.

“The migration of residents, and their talent and financial capital away from cities like Toronto and Vancouver to communities in surrounding regions or to provinces such as Alberta foreshadow trends in sales activity, housing prices and real estate market performance. This applies to the cities they are leaving and the markets they are moving to, and it applies across the conventional and luxury markets.”

Article content

Advertisement 3

Article content

In Vancouver, interprovincial migration fell to its lowest level in more than 20 years, with the city losing 4,795 people to other provinces — a loss that is reflected in its real estate market.

In the first half of 2024, residential sales of homes valued at more than $4 million were down 16 per cent compared to the same period last year, while sales of those over $10 million were down 50 per cent.

Luxury condo sales of more than $4 million were up 27 per cent, though the report noted the luxury condo market was soft due to a “confluence of elevated prices and carrying costs, a shift in luxury consumer preferences towards single family homes and problematic conditions in the city’s downtown core.”

In the City of Toronto, luxury real estate remained fairly resilient, as the number of homes sold for more than $4 million climbed four per cent, while properties sold for more than $1 million were down seven per cent. In total, three homes were sold for more than $10 million.

In Montreal, which remains firmly in a “buyer’s market,’ according to the report, home sales of more than $4 million climbed 29 per cent, while those of more than $1 million climbed 25 per cent.

Advertisement 4

Article content

“Prospective home buyers and investors continued to navigate the market at a leisurely and empowered position, with extended home searches and negotiations the norm,” the report states.

Sign up here to get Posthaste delivered straight to your inbox.

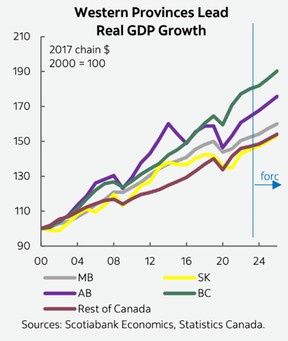

The west is best?

When it comes to growth in gross domestic product over a 20-plus year period, it sure appears so.

Real GDP growth in western Canada since 2000 has largely outpaced the rest of the country and continues to stand out despite the current economic slowdown. Even British Columbia, which has been disproportionately hurt from Bank of Canada rate hikes, outperforms the eastern provinces.

This trend may not last for the next decade, however, as emissions reduction target could put a damper on continued growth in the region.

Read the report from Scotiabank here.

- Bank of Canada will announce its interest rate decision at 9:45 a.m. ET and release its Monetary Policy Report, followed by a press conference with governor Tiff Macklem.

- Today’s Data: U.S. home sales for June

- Earnings: AT&T Inc., Ford Motor Co., Teck Resources Ltd., Rogers Communications Inc.

Advertisement 5

Article content

Recommended from Editorial

-

Are interest rates or price more important to homebuyers?

-

Canadians’ migration to the Maritimes is losing steam

U.S. President Joe Biden’s decision to step down from the presidential race over the weekend can teach us a lot about our finances as we age, Ted Rechtshaffen writes. When it comes to an aging loved one, difficult discussions about when to give up control of their finances can challenging, but there are some ways to make it a little smoother. Read his column here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

Advertisement 6

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Ben Cousins, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Credit: Source link