The debate about Bitcoin (BTC) vs. gold as a store of value has been heating up in recent years thanks to the increasing value of the top cryptocurrency, and according to ARK Invest CEO Cathie Wood, the launch of the first spot BTC ETFs has tilted the discussion in favor of Bitcoin.

“Last year, during the regional bank crisis in March, Bitcoin shot up 40% as the KRE, the regional bank index, was imploding,” Wood said during a Sunday interview with Brett Winton, the chief futurist at ARK Invest. “And here again, the regional bank index is acting up, and after a little bit of a correction after 11 ETFs were introduced, we are seeing Bitcoin catch a bid again.”

“So this idea that it’s a flight to quality or a flight to safety is really asserting itself here,” she added.

Touching on the topic of Bitcoin’s price sell-off in the wake of the ETF launches, Wood said their view is that its price declined “because there was a lot of anticipatory buying before the ETFs came out.”

“There was a bit of ‘sell-on-the-news’, these are the trading types who just are very opportunistic in that way,” she said.

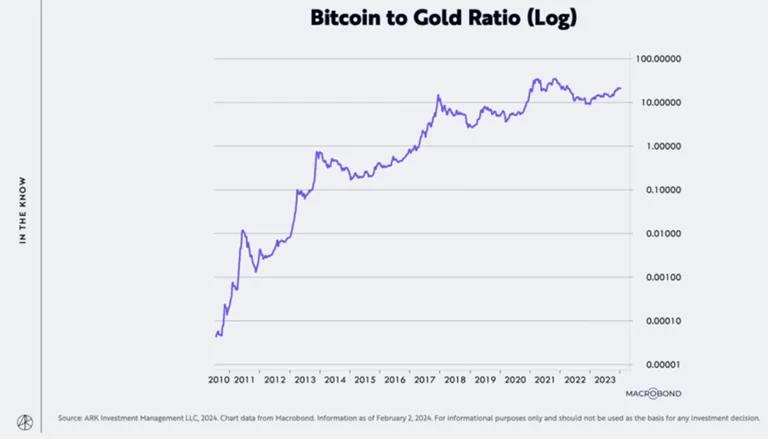

Moving on to the performance of Bitcoin relative to gold, Wood provided the following chart which shows a strong uptrend in favor of BTC, and said it suggests that BTC is in the process of partially replacing the yellow metal.

“This chart just shows you that even relative to gold, Bitcoin has been rising,” she said. “There’s now a substitution into Bitcoin and we think that is going to continue now that there is a much easier way, less friction-filled way to access Bitcoin.”

Data provided by TradingView shows that the correlation between Bitcoin and gold has been rising since the ETFs launched on Jan. 11.

BTC correlation with gold. Source: TradingView

Wood said she wasn’t surprised by the 20% pullback for BTC and had previously predicted that it would be a “sell the news event.” She cited the fact that 15 million of the 19.5 million BTC in circulation haven’t moved in 155 days as evidence that the majority of hodlers have “strong hands” and prefer to focus on the long-term gains.

Data provided by Longtermtrends shows that the 1-year rolling correlation between Bitcoin and gold is now 0.8, the second-highest level in history behind the 0.82 reading posted on Nov. 4, 2023.

Historically, Bitcoin and gold haven’t been correlated over the longer term, but recently both have rallied together. According to the 2024 Look Ahead report from Fidelity, Chris Kuiper, Director of Research at Fidelity Digital Assets, noted that “Bitcoin has rallied much higher, leading us to wonder: if investors are flocking to real assets and continue to do so, will the narrative shift to bitcoin as ‘gold on steroids’?”

Related: Bitcoin may be evolving from ‘growth stocks on steroids’ to ‘gold on steroids’ – Fidelity’s Chris Kuiper

Kuiper, like Wood, also sees the current cohort of Bitcoin holders as willing to hold out longer for a greater return.

“With each cycle, more coins have moved to stronger hands, or those with much more conviction and/or longer investment time horizons,” Kuiper wrote. “We think that this will also continue to play into that strong foundation upon which 2024 will be built.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link