Bitcoin’s price has been stuck in a range, with its last trade above $90,000 occurring on March 7. By the end of the previous year, Bitcoin had surpassed the $100,000 mark, but this milestone was short-lived as the price quickly fell. Since then, Bitcoin has been on a downward trend, even dipping below $80,000.

Adding to the market’s struggles, President Trump’s tariff announcement put additional pressure on the crypto space, causing most cryptocurrencies to suffer alongside Bitcoin.

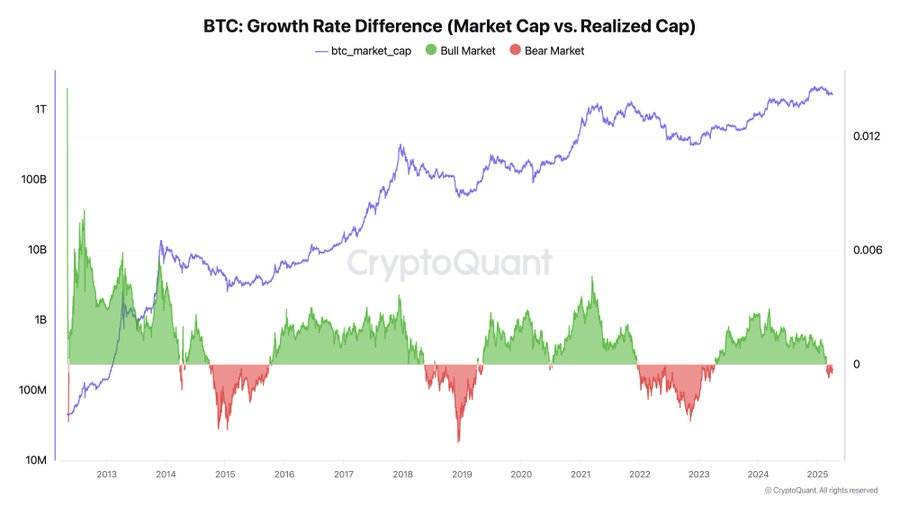

According toCryptoQuant CEO Ki Young Ju, Bitcoin bull market appears to be over, based on on-chain data analysis. The key metric is Realized Cap, which measures the actual capital entering the market by tracking when BTC is bought (entered a wallet) and sold (left a wallet).

“But when sell pressure is high, even large purchases fail to move the price. There are simply too many sellers. For example, when Bitcoin was trading near $100K, the market saw massive volumes, but the price barely moved,” he explained.

When the Realized Cap grows but the Market Cap (based on the latest trading price) stays flat or drops, it signals that money is flowing in, but prices aren’t responding—this is a bearish sign. Right now, that’s exactly what’s happening.

In contrast, if small amounts of new capital push prices up, it’s a bullish market. But currently, even large amounts of capital aren’t enough to move Bitcoin’s price, indicating a bear market. Historically, real market reversals take at least six months, so a quick recovery is unlikely.

“In short: when small capital drives prices up, it’s a bull market. When even large capital can’t push prices upward, it’s a bear. Current data clearly points to the latter. Sell pressure could ease anytime, but historically, real reversals take at least six months—so a short-term rally seems unlikely,” he concluded.

Credit: Source link