Macro Scenes:

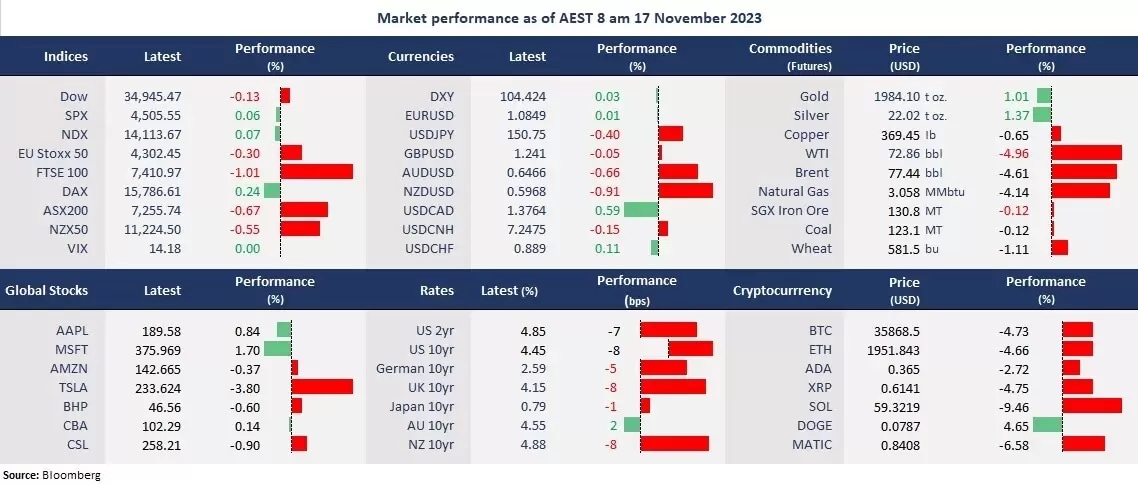

- Stock markets mixed: Wall Street finished mixed as consumer stocks fell and tech shares remained strong. In the S&P 500, consumer sectors slumped after Walmart expressed cautionary outlooks. The US unemployment claims climbed, while the Philly Fed manufacturing index stayed in contractionary territory for the third straight month in November.

- Haven assets surged: Precious metal prices, including gold and silver, surged as haven demands increased. The haven currency, the Japanese Yen, also strengthened, with USD/JPY falling 0.4%.

- Treasury yields fell: The US Treasury yields slumped following tepid economic data as markets continued to price a sooner end of the Fed’s hiking cycle. Safe haven flows also lifted bond prices.

- Commodity currencies slumped: The AUD, NZD, and CAD weakened due to risk-off sentiment amid falling industrial metal and energy prices.

- Crude oil tumbled: Crude oil markets deepened losses to the lowest since July on worries of a record high US oil production and slowing down the global economy. Especially, China reported that home prices fell the most in eight years.

- Asian markets to open lower: Chinese markets slumped after Alibaba scrapped its plan to spin off the cloud business, dragging on other big tech stocks. The Hang Seng Index futures were down 1.5%. The ASX 200 futures fell 0.04%.

Chart of the Day:

Microsoft (NDX: MFST), daily

Company News:

- Alibaba Group (NYSE: BABA) tumbled 10% after the Chinese e-commerce giant called off a spinoff of the cloud business due to tightened US restrictions on critical chip exports to China. The company said it “may not achieve the intended effect of shareholder value enhancement” because of the matter.

- Walmart (NYSE: WMT) slumped 8% despite a beat on earnings expectations as the retailer expressed concerns about weakening consumer power due to an economic slowdown. CEO Doug McMillon said the company “may be managing through a period of deflation in the months to come” in the US. Its guidance for EPS was also short of forecasts.

- Amazon (NDX: AMZN) reached an agreement with Hyundai Motor Co. that enables its customers to buy vehicles on the e-commerce platform next year. It’s the first deal that Amazon made with a car dealer, which may prompt other car makers to follow suit.

Today’s Agenda:

- New Zealand’s PPI for September

- UK Retail Sales for October

- EU CPI for October

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Credit: Source link