The overall crypto market sentiment turned bearish as major assets like Ethereum (ETH) and Bitcoin (BTC) registered massive price drops over the past 24 hours. Amid this, Ethereum, with a significant 7% price drop, has reached a key level that currently acts as a make-or-break situation for the asset.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, with a notable price decline, Ethereum has reached a key level of $1,820 for the second time this month and appears to be weakening this level, signaling a potential further decline.

Based on recent price action and historical patterns, if the asset fails to hold this level and closes a daily candle below the $1,800 mark, there is a strong possibility it could drop by 18% to reach the $1,490 level in the coming days.

Meanwhile, on the weekly time frame, Ethereum is already weak and in a downtrend as it trades below the 200 Exponential Moving Average (EMA) on the daily time frame. In addition, despite ETH showing upside momentum in early March 2025, it successfully retested its breakdown level and is now on the verge of a massive price decline.

If ETH continues to hold this pattern, it will open a path for Ethereum to reach $1,200 or even lower.

Current Price Momentum

At press time, Ethereum is trading near $1,870, having registered a 7% price drop over the past 24 hours. However, during the same period, its trading volume jumped by 50%, indicating heightened participation from traders and investors compared to the previous day.

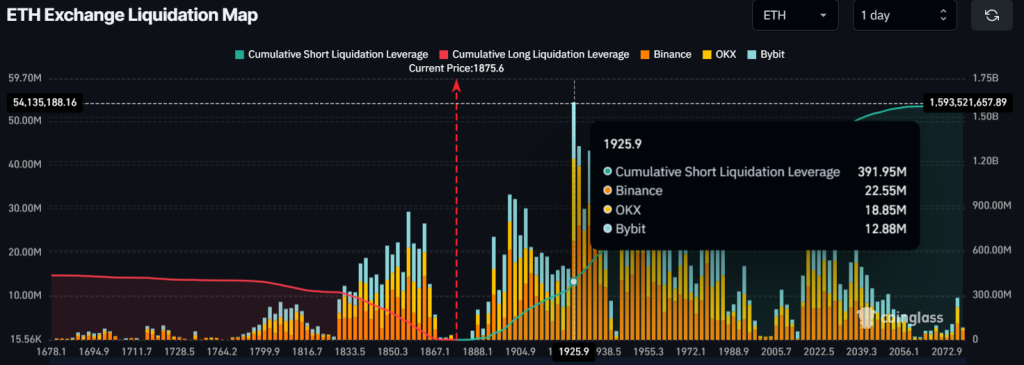

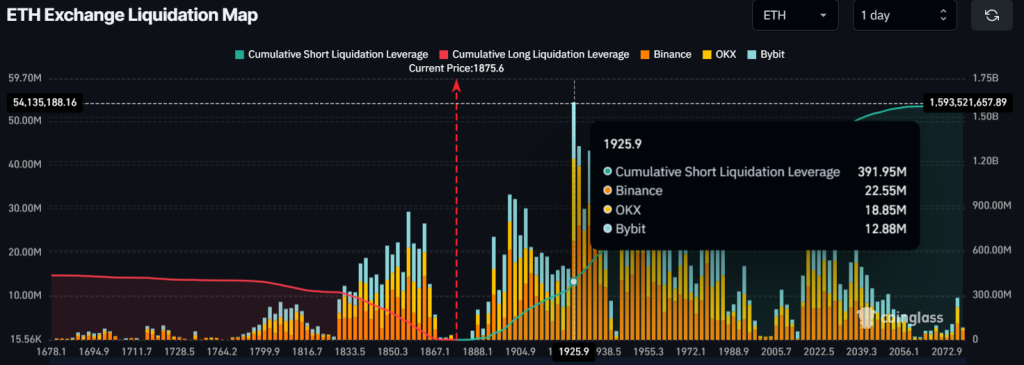

$391 Million Worth of Short Bet

Despite a significant jump in trading volume, Ethereum traders remain bearish, following the broader market sentiment, as reported by the on-chain analytics firm Coinglass.

Data reveals that traders betting on the short side are currently over-leveraged at $1,925, having built $391 million worth of short positions at this level. Meanwhile, traders betting on the long side are over-leveraged at $1,855, with $120 million worth of long positions.

This clearly indicates that bears are dominating and could easily liquidate long positions while pushing ETH’s price lower.

Credit: Source link