Last week, Bitcoin (BTC) experienced significant volatility. Conflicting market signals created bearish pressure, preventing traders from setting a clear directional trend. As a result, major altcoins like Ethereum and XRP dropped below crucial price points. However, following hints from US CPI and PPI data that inflation may be easing, the market rallied, setting the stage for a potentially bullish week ahead.

Interest Rate Decision Could Revive Crypto

Amid a 2% drop last week, Bitcoin continues to face significant downside risks due to multiple bearish macroeconomic pressures.

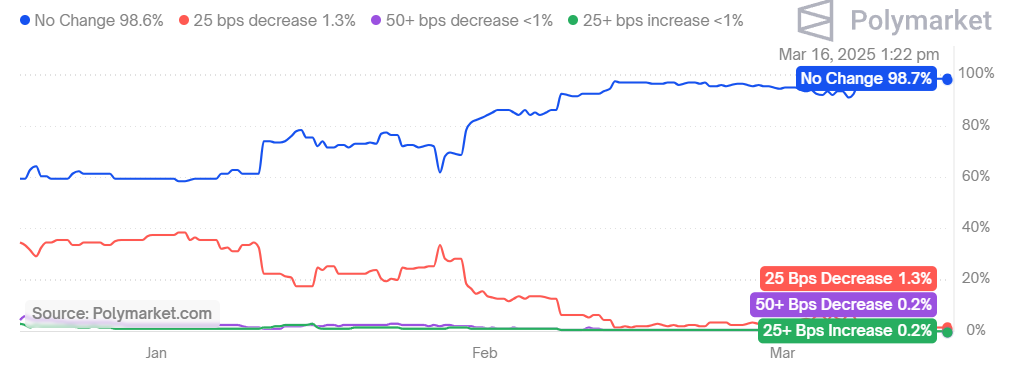

On a brighter note, analysts in the crypto prediction markets, such as Polymarket, are optimistic about a potential pause in Federal Reserve rate hikes next week. Additionally, there is growing hope that geopolitical tensions between Russia and Ukraine might ease.

Bettors on Polymarket are pricing in a 99% likelihood of the Fed pausing rate hikes in March, with the odds of a Russia-Ukraine ceasefire reaching nearly 80%. Should these developments occur, a surge in risk appetite could lead to increased investments in Bitcoin and other cryptocurrencies, potentially triggering further upward momentum next week.

Bitcoin Price Prediction

Bitcoin bulls are attempting a recovery, though they are likely to encounter significant resistance between the EMA20 trend line and the $86.7K mark. Currently, the BTC price stands at $84,262, having risen by 0.09% in the past 24 hours.

If the price remains above the 20-day EMA, it could suggest that the recent dip below $84K was merely a bear trap. Under such circumstances, the BTC/USDT pair might climb to the critical $86.7K level and potentially extend to $93,000.

On the other hand, if the price sharply declines from this resistance zone, it would suggest that bears have the upper hand. This could increase the likelihood of a drop to the crucial support level at $79,974.

Ethereum Price Prediction

Ether has been facing rising volatility around the descending resistance line, suggesting increasing domination among buyers and sellers. ETH price has been consolidating below the crucial $2K mark. As of writing, ETH price trades at $1,923, surging over 0.2% in the last 24 hours.

The Relative Strength Index (RSI) is beginning to exhibit early signs of a positive divergence. Should the price breach the EMA50 trend line, the ETH/USDT pair might ascend to the breakdown level of $2,109. At this level, bears might intensify their selling efforts; however, if the bulls manage to sustain their momentum, the pair could advance towards the 50-day SMA at $2,530.

This positive outlook would be invalidated if the price fails to hold at $2,109 and subsequently falls below $1,772. Such a move would indicate a bearish dominance.

XRP Price Prediction

XRP bounced off the $2 support level and broke above the EMA20 trend line on the 1-hour chart. Bears are attempting to stop the recovery at this EMA, but continued buying pressure from bulls suggests a potential breakout above it.

If successful, the XRP/USDT pair could climb to $2.65. Surpassing this level might set the stage for a rally to $2.97.

Conversely, a sharp decline from the current level would indicate that sentiment remains bearish. In such a case, the pair might revisit the critical $2 support.

Credit: Source link