(Kitco News) – The Chinese government’s true gold holdings are more than double the official numbers, and the country’s sovereign and citizen purchases have made China the dominant force in precious metals markets, according to a new analysis by Gainesville Coins’ Jan Nieuwenhuijs published on Thursday.

“Exceptional strong gold demand from both the Chinese central bank and private sector has been driving up the gold price over the past two years, by which they have taken over gold pricing power from the West,” Nieuwenhuijs wrote. “The People’s Bank of China (PBoC) bought a record 735 tonnes of gold in 2023, of which about two thirds were purchased covertly. In addition, the private sector net imported 1,411 tonnes in 2023, and a whopping 228 tonnes just in January of 2024.”

“If the West joins the Chinese gold buying craze, in fear of rate cuts and currency debasement, it will be a perfect storm for gold,” he said.

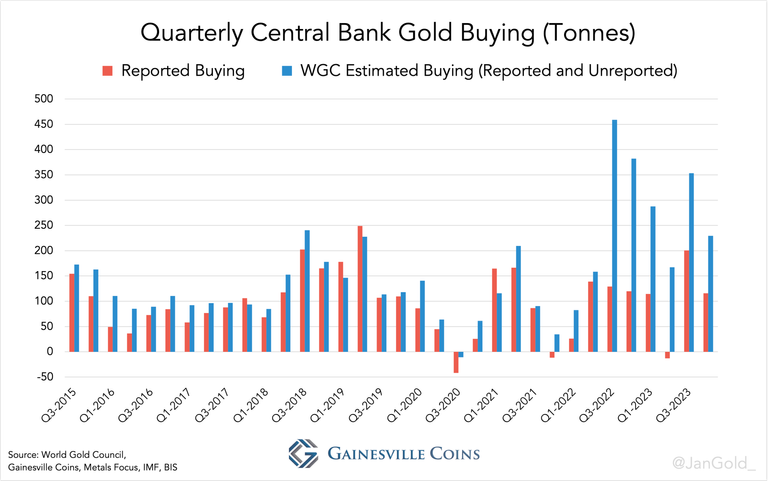

Nieuwenhuijs wrote that since the start of the Russia-Ukraine war and the weaponization of the U.S. dollar, central Bank gold purchases have risen dramatically. But while the sovereign purchasing rates captured in the official data are impressive enough, he said a great deal more gold is being bought behind the scenes, with the PBoC the biggest customer. “Covert PBoC gold purchases can be computed by comparing the WGC’s data with what is officially reported by central banks,” he said.

Nieuwenhuijs wrote that according to two industry insiders, the difference between central banks’ self-reported buying and the WGC’s estimates (based on field research) is largely explained by the PBoC’s unreported gold purchases.

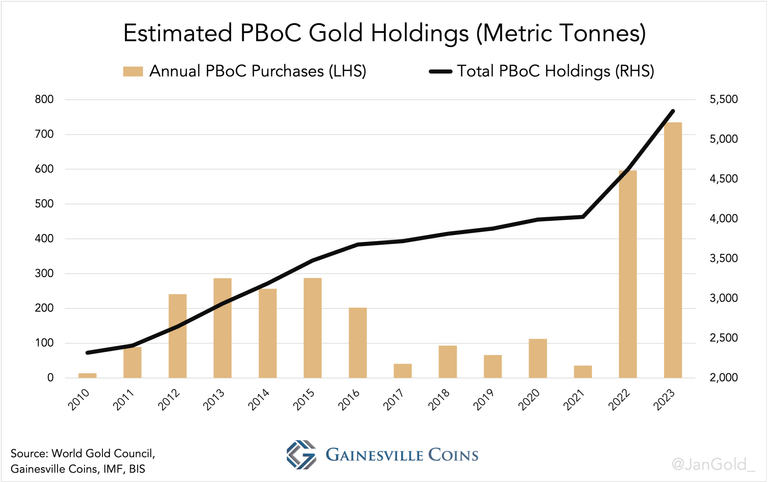

“To compute what the PBoC secretly acquires every quarter I take eighty percent of total unreported purchases. Then, I add what the Chinese central bank reports to have bought,” he said. “In total, over 2023, the PBoC bought a record 735 tonnes, up 23% from the previous record in 2022 at 597 tonnes.”

Nieuwenhuijs now estimates that the PBoC actually has 5,358 tonnes of gold, in its reserves, which is 3,108 tonnes more than the 2,250 tonnes that they’ve officially disclosed.

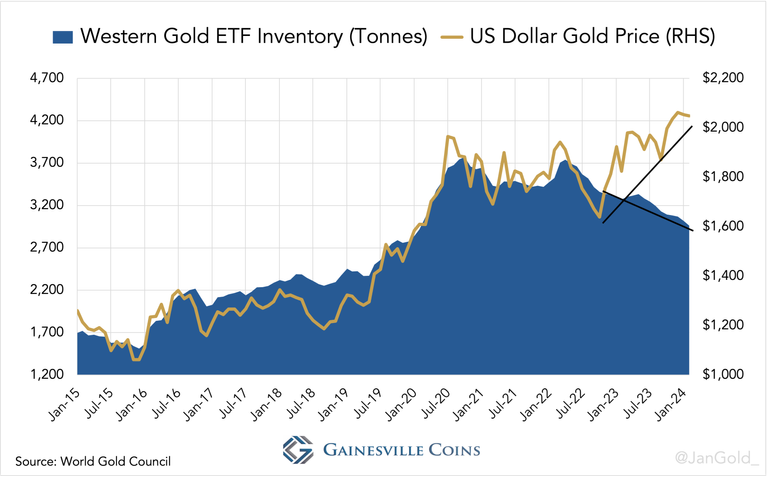

He said that China’s massive and ongoing gold demand, from both the government and the citizens, has fundamentally changed the gold market. “Whereas before 2022, Western institutional supply and demand was driving the price of gold and the price was more or less stuck to the ‘real yield’ (10-year US TIPS interest rate), ever since the war gold has been less sensitive to real yields and follows its own path,” he wrote. “This divergence, according to my analysis, has been created by China that has become one of the main driving forces of the gold price.”

Nieuwenhuijs noted that since the PBoC began its current buying spree in the second half of 2022 the gold price has been trending up, despite the fact that the West was a steady net seller during this time.

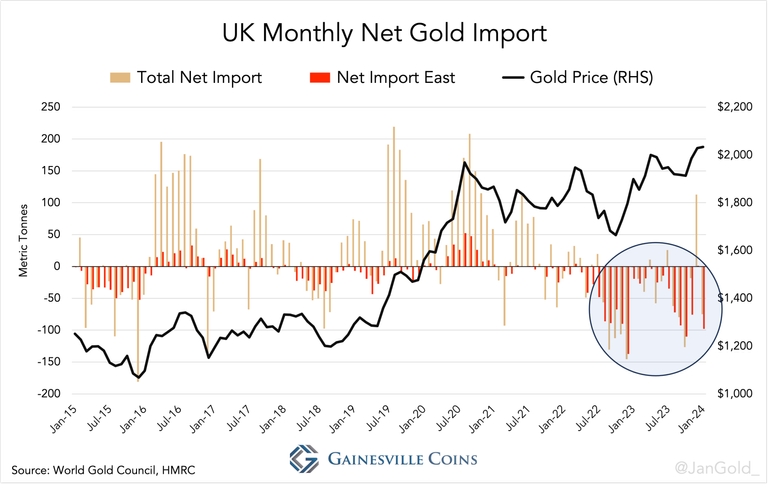

“Worth noting is that since 2022 total net exports from the UK are roughly equal to the UK’s net export to the East,” he wrote. “Increasingly, gold flowing out of London is bypassing Switzerland and is shipped directly to Asia where the 400-ounce bars from the London Bullion Market are recast into 1 Kg bars for the regional market. Global refining capacity is shifting East as well.”

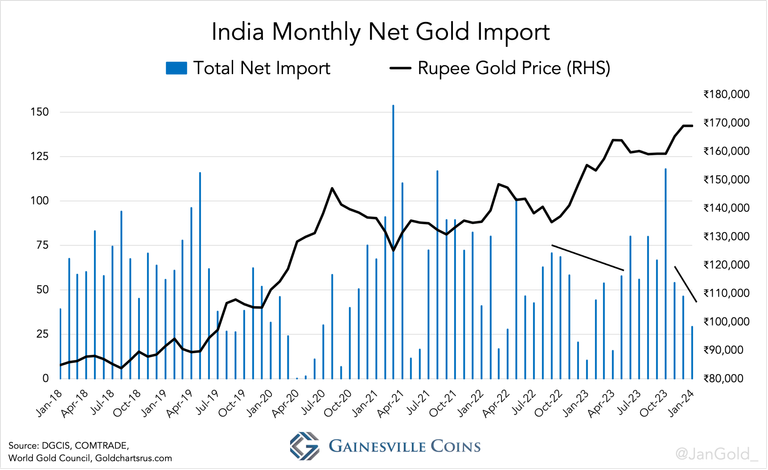

Since the second half of 2022, Nieuwenhuijs said the UK’s largest clients in the East were India, China, and Hong Kong. “India, though, is still price sensitive,” he noted. “The Indians didn’t drive up the price.”

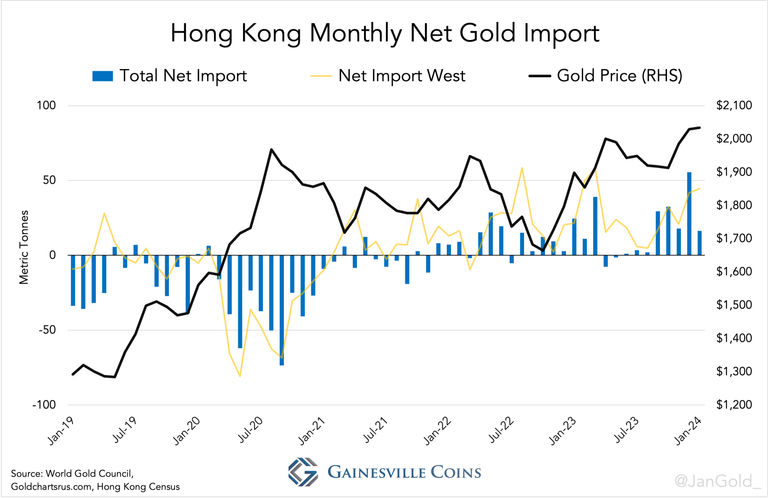

He said that Hong Kong did show an increase in gold imports while the price went up during this period, which could be due to “the PBoC buying gold in Hong Kong (monetizing it in Hong Kong and then repatriating it off the radar), affluent Asian citizens buying and storing gold there, or bullion banks storing gold there in anticipation of strong demand in the East.”

He pointed out that when the gold price went up in the past, Hong Kong would become a net exporter and the West would be its biggest customer, as they did in 2020. “But since 2022, the West is a supplier while the gold price rises,” he said. “Likely, Hong Kong has also become one of the driving forces of the gold price.”

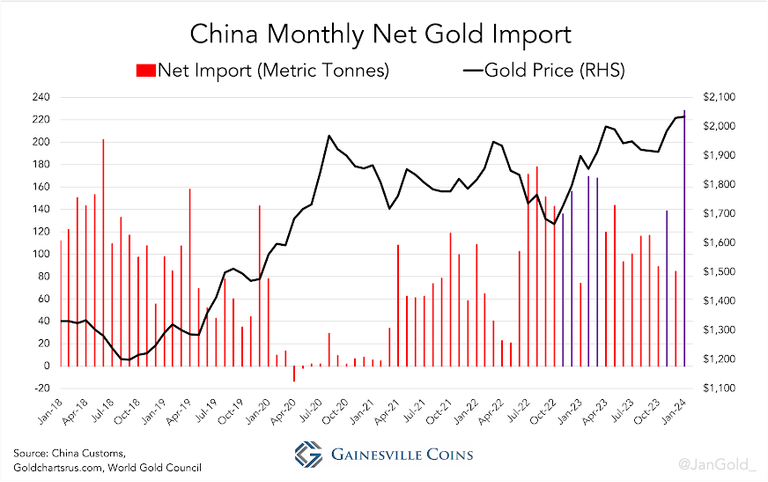

Turning to the mainland, Nieuwenhuijs wrote that as the real estate sector in China began to collapse in late 2021, citizens “started changing their gold buying behavior” and became price-insensitive. “One explanation could be that because of capital controls Chinese investors have few places to go other than the local stock market, real estate, and gold,” he said. “And when the former two are in the doldrums, which is currently the case, the latter attracts more attention.”

“In the above chart you can see how Chinese gold investors have changed, shifting from increased buying when the West sells, providing a floor for the price, to strong buying when the price is ascending, being a driving force,” he wrote. “Compare the periods from mid-2018 until mid-2020 and early 2022, when the price went up and Chinese imports plummeted, to the periods from mid-2022 through early 2023 and late 2023 until January 2024, when the price went up and imports increased or remained robust.”

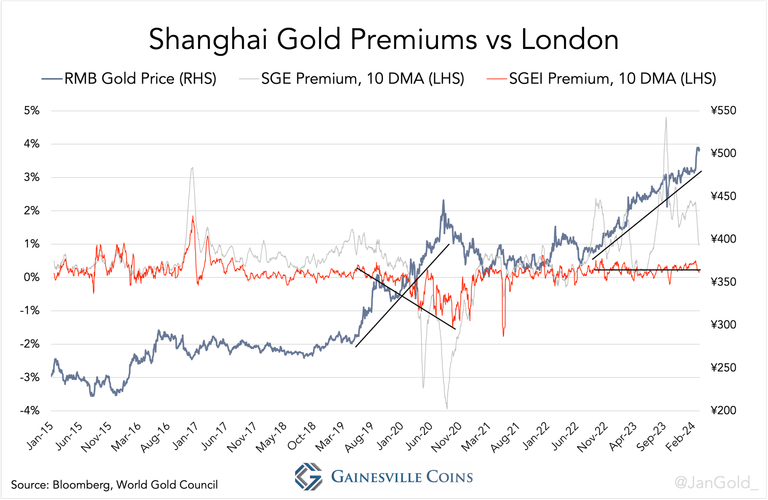

Nieuwenhuijs said the same pattern has played out in Shanghai gold premiums. “Before 2022, these premiums fell when the price rose and vice versa,” he said. “Now premiums stay positive during gold rallies.”

Nieuwenhuijs’ conclusion is that the PBoC and the Chinese private sector have been the driving forces behind gold price appreciation since the start of the Russia-Ukraine war.

“Besides the obvious reasons for owning gold, I have outlined why Chinese people have altered their gold investment strategy,” he said. “But what about the PBoC?”

He wrote that the strong covert purchases reflect “hidden de-dollarization” by the PBoC. “Although the dollar is still the world’s premier reserve currency, China and other countries are trying to move away from it,” Nieuwenhuijs said. “The weaponization of the dollar is a threat to their dollar reserves, as is the debt spiral the US has entered.”

Nieuwenhuijs said that “China’s influence on the gold price in the past two years should be clear,” though he’s still not sure who is driving the current rally that began at the end of February.

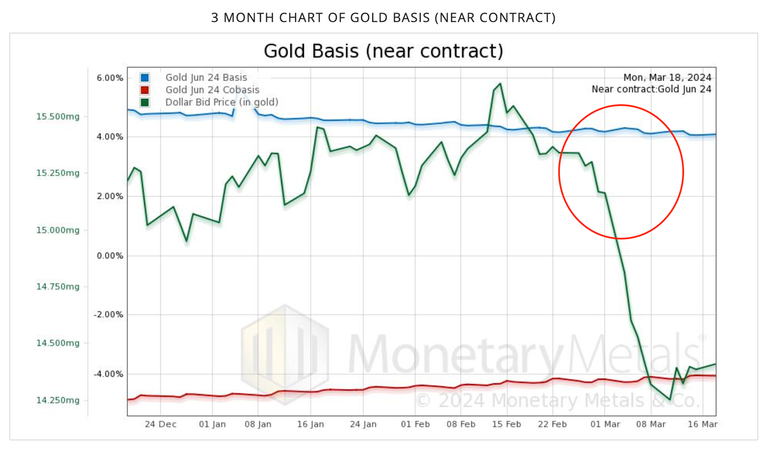

“Initially I thought it was speculators on the COMEX. Open interest of gold futures skyrocketed exactly when the price started climbing,” he said. “But if it was purely the futures market driving the price higher, we would see fingerprints in “the basis” (the spread between the futures and spot price). However, the basis shows nothing of that sort, according to data by Monetary Metals. It seems as if futures and spot traders are both driving up the price.”

Nieuwenhuijs said markets will know more when the Q1 2024 trade and supply and demand data come out. “Quite possible, the Chinese are flexing their muscles once again, forcing gold into the next stage of the current bull market,” he concluded.

“As the gold price will be making new all-time highs I expect more Western investors to join buying gold, through ETFs and outright, as they will fear currency debasement just as the Chinese central bank,” he said.

“It will be a perfect storm for gold.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link