Onyx Gold Corp. May 9 announced that it has entered into an option agreement to acquire the WEAS property from Senoa Gold Corp .; claims contiguous with the company’s King Tut project in Yukon’s Tombstone Gold Belt.

Spun out last year from properties previously held by HighGold Mining Inc., Onyx Gold holds 100% interest in four separate properties sandwiched between Snowline Gold’s Rogue and Olympus (previously named Golden Oly) in eastern Yukon and three properties in the Timmins area in Ontario.

With a total of 1,075 claims sprawling across 21,000 hectares (51,892 acres), the company’s Yukon portfolio includes the King Tut, RGS, Canol, and Stan properties. Among these, King Tut stands out as the most captivating, nestled in the core of a burgeoning, minimally intrusive-related gold district. Meanwhile, its Ontario holdings extend over 34,300 hectares (85,004 acres) and encompass the Muro-Croesus, Golden Mile, and Timmins South properties.

Now, Onyx plans to expand its portfolio with the addition of a new property, enriching its already diverse array of assets.

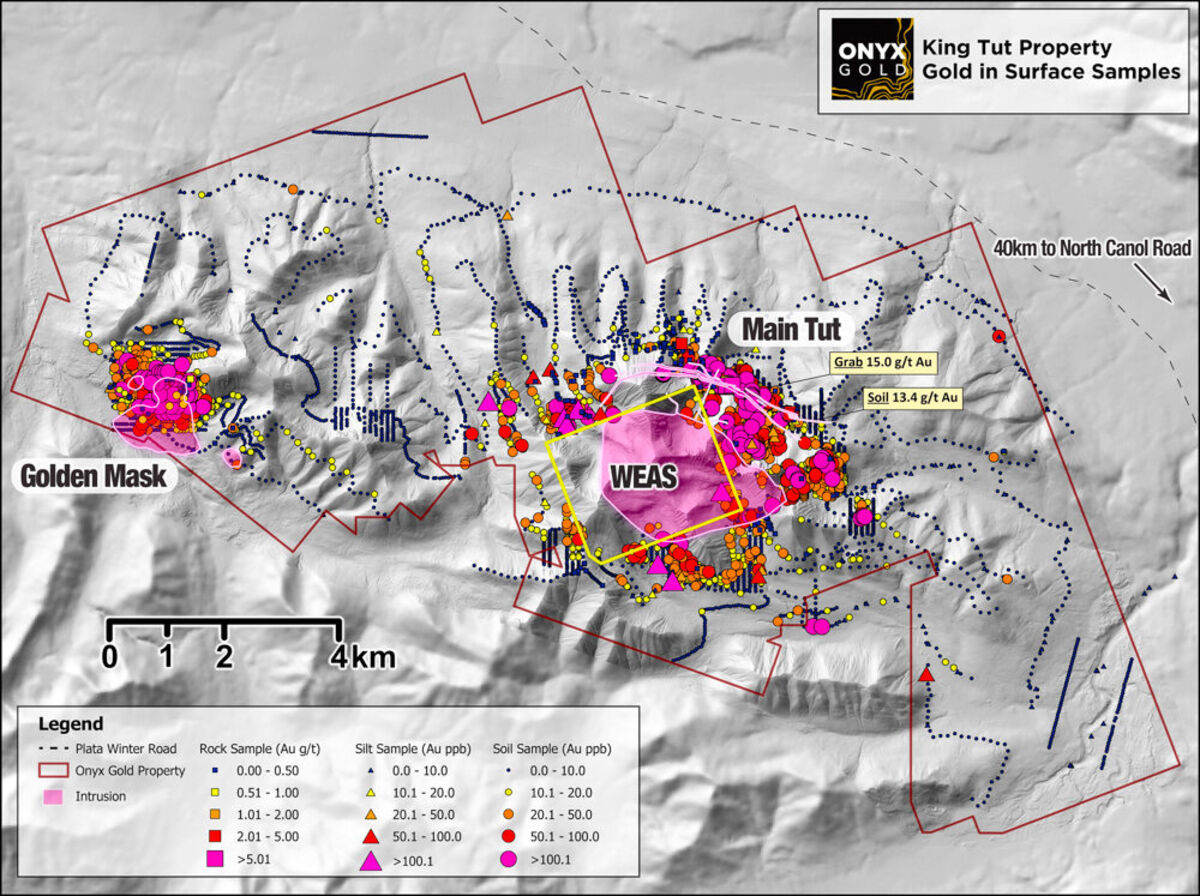

Located within the King Tut property itself, WEAS comprises 30 claims on 647 hectares (1,549 acres) and covers an intrusion target situated between the Golden Mask and Main Tut targets.

Under the terms of the agreement, Onyx will acquire WEAS by issuing Senoa 3 million common shares. This includes 500,000 shares upon closing, 500,000 on the first anniversary, 500,000 on the second, and the remaining 1.5 million on the third.

Additionally, the property is subject to an underlying obligation to an undisclosed third party that consists of a 1% net smelter royalty and bonus payment of US$1 million, payable by the optionee if a measured or indicated mineral resource greater than one million ounces is disclosed.

“This agreement underscores our commitment to consolidating our position and unlocking the full potential of our assets in this emerging new mining camp,” said Onyx Gold President and CEO Brock Colterjohn. “The property presents a compelling opportunity with historical data indicating significant gold potential associated with exposed, multigenerational sheeted quartz veins within a granitic intrusion.”

Known to hold a prospective reduced intrusion-related gold target, historical work completed by previous operators reported multigenerational gold-bearing sheeted quartz veins within an exposed 3,000- by 2,000-meter granitic intrusion.

While no significant exploration has been conducted in the past few decades, surface grab samples collected during the 1990s returned grades as high as 20 grams per metric ton gold and one hole drilled in 1996 cut 21 meters averaging 1 g/t gold.

Eager to tap into this potential prospect, Onyx is already planning an early summer work program that will entail field mapping, prospecting, and channel sampling to prioritize potential drill targets within areas of exposed gold-bearing sheeted quartz veins.

“Our upcoming field program aims to further delineate targets for exploration, marking an exciting step towards our goal of unlocking a new gold discovery in the prolific Tombstone Gold Belt,” said Colterjohn.

Of note, the company adds that none of the historical results from WEAS, including the drill results, have been verified as assay methods and sampling techniques were not disclosed in the reports.

In the case of WEAS specifically, Onyx has only been able to locate indirect references to the results but no primary source. Historical results discussed herein are presented more generally as an indication of the potential of the property to host reduced intrusion-related gold systems.

Other business

Aside from the planned work at WEAS, the company is in the process of developing a budget and early summer exploration program for 2024. Although work at WEAS is part of it, follow-up fieldwork at Golden Mask and Main Tut is also planned based on last year’s encouraging results.

The 2023 exploration program focused on initial drill testing of the promising Main Tut and Golden Mask gold-in-soil anomalies, which are associated with two separate intrusion-related gold systems, and the execution of property-wide geophysical surveys, geochemical surveys, and mapping and prospecting programs to refine drill targets and identify prospective area for future exploration.

Results from the inaugural nine-hole, 2,123-meter drill program confirmed widespread gold mineralization across the Main Tut and Golden Mask anomalies, including 32.5 meters averaging 0.30 g/t gold in hole KT23-005, validating the existence of potential bulk-tonnage reduced intrusion-related gold systems on King Tut.

In addition, new airborne magnetic surveying and soil sampling have also significantly expanded the size of the mapped intrusions at both targets.

Aside from this, as previous property holder HighGold is currently undergoing talks to merge with Contango ORE Inc., Onyx also announced that HighGold has proposed to enter a 15-month lock-up agreement to the order of five million Onyx shares.

As HighGold retains roughly 20% ownership of Onyx after divesting its properties into another company, under the terms of the proposed lock-up, HighGold has agreed not to sell, swap or otherwise transfer any of its shares of Onyx without the prior written consent from the company for a period of 24 months from the lock-up date, subject to automatic timed releases of 25% to be released 15 months from the lock-up date, and 25% to be released every three months thereafter.

In the event that HighGold and Contango reach an agreement, it was explicitly stated that Contango would adopt this lock-up agreement.

Credit: Source link