After consolidating for over a year, Ripple’s native token (XRP) has broken out from a bullish price action pattern and is now poised for notable upside momentum. However, XRP experienced this crucial breakout as United States Securities and Exchange Commission (SEC) Chairman Gary Gensler hinted at his resignation.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP appears bullish as it has broken out from an ascending triangle price action pattern on the weekly time frame and closed a daily candle above the neckline at the $0.75 level. Following the breakout and candle closing, the sentiment has completely shifted from a price correction phase to an uptrend.

Based on technical analysis and historical price momentum, XRP is poised for a 75% upside rally to reach the $1.35 level. It has closed a daily candle above the crucial $0.75 level. Before achieving this 75% rally, the asset may encounter strong resistance near the $0.90 level.

Historically, this level has acted as strong resistance and created selling pressure as the price approaches the $0.90 mark. However, considering the current market sentiment and speculation around Gary Gensler’s resignation, XRP could benefit and potentially breach this significant hurdle.

As of now, XRP is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend.

Bullish On-Chain Metrics

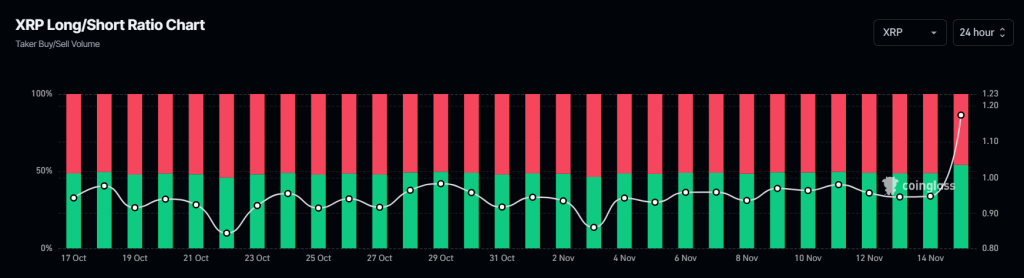

On-chain metrics further support XRP’s bullish outlook. According to the on-chain analytics firm Coinglass, XRP’s Long/Short ratio currently stands at 1.18, the highest since August 2024. This notable jump in the ratio suggests strong bullish market sentiment among traders.

Currently, 54% of top traders hold long positions, while 46% hold short positions. Additionally, XRP’s open interest has experienced an aggressive spike. According to the data, the asset’s OI has surged by 24% in the past 24 hours and by 12% in the past four hours.

Current Price Momentum

At press time, XRP is trading near the $0.80 level and has registered a price gain of over 18% in the past 24 hours. During the same period, the asset’s trading volume jumped by 35%, indicating heightened participation from traders and investors following the bullish breakout.

Credit: Source link