BNB is experiencing buying demand as overall market sentiment turns positive. Although the price is currently facing resistance below the $600 level, buyers are expected to overcome this barrier. Meanwhile, large holders continue to accumulate BNB during the recent price correction. This has sustained momentum across various on-chain indicators, supporting the ongoing recovery.

BNB’s Open Interest Rises Despite Negative Funding Rate

While many altcoins have dropped by as much as 98% from their all-time highs, Binance Coin (BNB) has shown strong buying demand, suffering much smaller losses alongside Bitcoin. This strength has made BNB a preferred altcoin for accumulation, even during the market decline. According to Coinglass data, BNB experienced a total liquidation of $97,300, with buyers accounting for $37,000 and sellers for about $60,000.

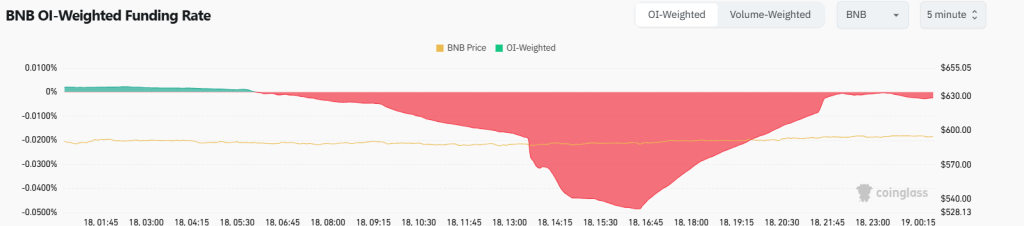

Despite the volatile market conditions, open interest in BNB continues to climb. Coinglass reports that BNB’s open interest has risen by 3.3%, reaching over $760 million. This growth in open interest could support the recovery and limit sharp declines. However, investor concerns remain, as the funding rate recently peaked in the negative zone at -0.485%, signaling caution.

The ongoing recovery has been further boosted by BNB’s latest quarterly token burn, completed on April 16. The network destroyed 1.57 million tokens, worth over $1 billion at current prices. These burns are typically calculated by the BNB price and the number of blocks produced over the quarter.

Also read: Binance Coin Price Prediction 2025, 2026 – 2030: Will BNB Hit $1000?

Token burns are a key part of BNB’s strategy to increase its value. According to the project’s tokenomics, quarterly burns will continue until the total circulating supply is reduced from around 140 million tokens to 100 million.

The long/short ratio currently indicates that BNB’s buying momentum is likely to continue. The ratio has surged to 2.1133, showing that a majority of traders, around 68% are betting on a price increase. This surging long positions could make it easier for BNB to break through the $600 resistance level.

What’s Next for BNB Price?

Binance Coin (BNB) continues to face resistance around the $610 level. Currently, it is trading near $595, showing a slight 0.66% gain over the past 24 hours. Sellers are working to keep the price below $600 in an effort to maintain a downtrend.

However, despite the increasing bearish sentiment, BNB shows signs of a potential rebound as large holders are accumulating near the dips. This accumulation is supporting a gradual recovery, and BNB could soon break above the $600 mark. The Relative Strength Index (RSI) also remains in bullish territory around 60, indicating that buyers are maintaining control of the momentum.

If buying pressure continues to build, BNB may break through the $610 resistance, potentially paving the way for a move toward the next key target at $644. Conversely, if selling pressure holds and BNB falls below the 20-day EMA support, the price could drop to the critical $557 level.

Credit: Source link