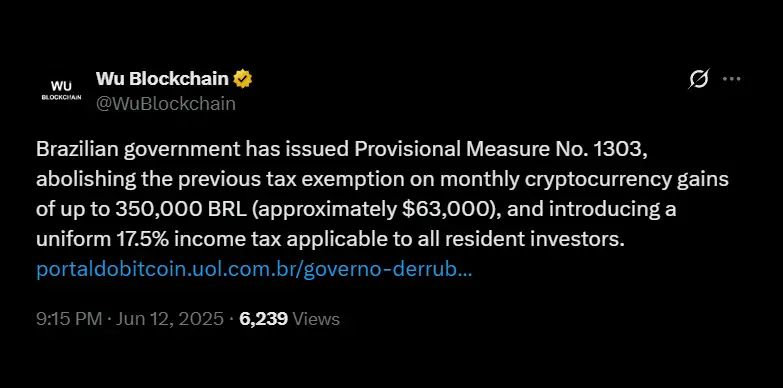

Brazil is getting ready to overhaul how it taxes crypto. The Brazilian government plans to scrap the long-standing exemption that lets investors pocket up to R$35,000 (about $63,000) in monthly gains without paying taxes. Instead, a flat 17.5% tax will be imposed on all profits from digital assets. It’s a major shift that signals Brazil is taking crypto a lot more seriously, and it’s going to impact everyone from casual traders to big institutional players.

Current Framework and Changes

Until now, Brazilian investors did not have to worry about paying taxes on crypto gains as long as their monthly transactions stayed under R$35,000. Anything beyond that was taxed progressively, between 15% and 22.5%, based on how much profit was made. That setup gave smaller investors a bit of breathing room, letting them trade or cash out modest amounts without owing the government anything.

Under the new rules, the exemption is gone. Every profit made from crypto, no matter how small, it is now subject to a flat 17.5% tax. This applies whether you are selling crypto for fiat, swapping one token for another, or even using digital assets to make a purchase.

Implications for Investors:

The new tax regime is expected to have broad implications:

- Increased Tax Burden: Investors who once remained under the exemption limit will now be taxed on all profits, which could significantly cut into their overall returns.

- Flat Tax System: Replacing the former tiered tax brackets, the new single-rate model may streamline reporting but could lead to a heavier tax burden for smaller investors.

- Tighter Oversight: Brazil’s Receita Federal already leverages sophisticated tools to track blockchain activity. With these new regulations, monitoring and enforcement are expected to become even more rigorous.

One-Time Tax on Crypto Income

Alongside the new flat tax on capital gains, the government will implement a one-time 17.5% tax on cryptocurrency income. This initiative is designed to bring crypto-related earnings in line with conventional income streams, reinforcing the broader effort to treat digital assets with the same fiscal accountability as traditional financial investments.

Brazil is moving fast to tighten its grip on crypto taxes. As one of Latin America’s biggest hubs for digital assets, the country is phasing out leniency and making space for stricter oversight. The upcoming changes are more than policy tweaks, they signal a shift in how the government views crypto: not as a fringe investment, but as a core part of the financial system. For investors, this means it’s time to take stock, and make sure everything’s in line. The message from regulators is loud and clear: crypto isn’t operating in the shadows anymore.

Also Read: Polygon Unveils Plan for Massive TPS Boost & Cross-Chain Liquidity

Credit: Source link