(Kitco News) – The gold price continues to consolidate around $2,400 an ounce as it recovers from last week’s volatility selloff from a record intra-day high; however, one market strategist said that gold still has plenty of upside momentum left.

In an exclusive interview with Kitco News, famed commodity investor Dennis Gartman said that gold did suffer some near-term technical damage last week as the market sold off sharply after hitting a record high above $2,448 an ounce; however, he added that the precious metal has embarked on a multi-year bull market.

“Gold goes a lot farther from here. I look for gold to hit $3,000 an ounce in the next couple of years,” he said.

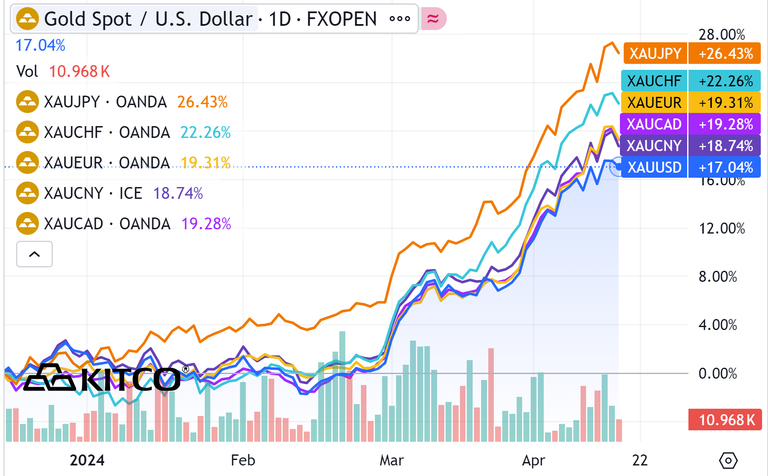

Gartman said he is bullish on gold because of the breadth of its record run. While investors pay attention to gold in U.S. dollar terms, Gartman pointed out that it is making record highs against the Swiss franc, the euro, the British pound, the Japanese yen, the Canadian dollar, and the Chinese yuan, just to name a few.

“This is more than just a weakness in the U.S. dollar. The real trade is gold against the yen and euro as the U.S. dollar strengthens against these currencies,” he said.

The U.S. dollar has made significant gains against major global currencies as market expectations around the Federal Reserve’s easing cycle continue to be pared back. There are growing expectations that the European Central Bank will start to ease its interest rates before the Federal Reserve.

Gartman said that he expects the U.S. central bank to cut interest rates only once or twice this year, and the easing will only start after the U.S. presidential election in November. However, he added that gold’s rally has grown beyond interest rates and bond yields.

Gartman noted that he sees a similar environment to the 1970s, where gold rallied as the Federal Reserve was forced to raise interest rates to double digits to combat inflation.

“I think the environment we are in is, in some ways, a lot worse than the 1970s. There is so much more confusion and uncertainty in today’s conflicts that will continue to drive safe-haven demand to gold,” he said.

At the same time, Gartman said that as geopolitical tensions continue to rise, there is a growing possibility that the U.S. government could weaponize the U.S. dollar against potential nations seen as bad actors.

“The U.S. government is looking at outright confiscating Russian funds, and if they do it once, they will do it again,” he said. “Some governments are seeing this threat and continue to move away from the U.S. dollar. Right now, the only alternative is gold. I expect we will continue to see central banks around the world continue buying gold. This has only just started.”

Gartman said that if China wants the yuan to compete with the U.S. dollar as a global currency, it needs to hold at least 20% of its reserves in gold. Even after buying gold for 17 straight months, its gold holdings represent slightly more than 4%.

The final reason why Gartman is bullish on gold is that despite this rally, investors continue to ignore the precious metal. At the same time, investors are also ignoring the mining space, which has yet to see any significant gains even as gold trades in rarified air.

Gartman said the only sector he sees peaking is in physical bullion as retail consumers race to Costco to stock up on one-ounce bars.

“That is a discouraging sign of saturation, but that is only one segment of the market,” he said.“I don’t see enough public participation in the gold market to say prices have peaked. The market will have peaked when the miners finally outperform gold prices.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link