Metals like gold and copper continue to trade at historically high levels, and producers like Centerra Gold (NYSE:CGAU) have garnered investors’ attention. The company has a lower cost of production advantage, which has recently translated to beats on top and bottom-line financials. The stock is up over 41% in the past year, though it trades at a relative discount. Investors looking for a mining stock offering value might find this option compelling.

Centerra’s Low Cost of Production

Centerra Gold is a Canada-based gold mining company with diverse mining operations, including running mines, exploration, development, and acquisition of gold and copper properties.

The company has two operational mines: Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. Apart from these, Centerra owns the Goldfield District Project in Nevada and the Kemess Project in British Columbia, Canada. It also owns and manages the Molybdenum Business Unit in the United States and Canada.

The company’s projected all-in-sustaining costs (AISC) for 2024 of $1,125/oz versus the $1,345/oz average AISC reported by its peers suggests a material cost advantage for Centerra, enhancing its profitability attractiveness.

Analysis of Centerra’s Recent Financial Results

The company recently reported strong Q1 results for 2024, beating EPS and revenue estimates. They announced a revenue of $305.8M, higher by $10.59M than estimated, showing a 35% year-on-year increase. Similarly, non-GAAP EPS was $0.15, $0.02 above expectations. An impressive cash flow was also maintained, with operating activities generating $99.4 million and free cash flow being $81.2 million.

The complete gold production was 111,341 ounces from Mount Milligan and Öksüt Mines. The copper production during the quarter was reported to be 14.3 million pounds. Total gold sales in the first quarter of 2024 were 104,313 ounces, fetching an average realized price of $1,841 per ounce. Copper was also sold on a large scale, with 15.6 million pounds sold at an average realized price of $3.12 per pound.

As of the end of the quarter, the cash and cash equivalents balance of $647.6 million and $399.3 million available under a corporate credit facility provided substantial liquidity of $1,046.9 million. The company declared a quarterly dividend of $0.05 per common share, equating to a dividend yield of 4.07%.

What Is the Price Target for CGAU Stock?

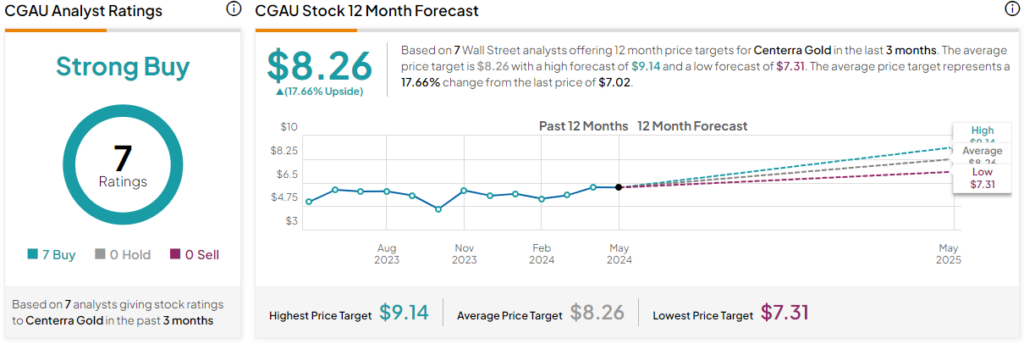

Analysts following the company have been constructive on the stock. Scotiabank analyst Ovais Habib recently raised the price target on the shares from $8 to $9 while maintaining an Outperform rating, citing an improved outlook for precious metals in 2024E and 2025E.

Centerra Gold is rated a Strong Buy based on the aggregation of ratings and price targets issued by seven Wall Street analysts over the past three months. The average price target for CGAU stock is $8.26, representing a 17.66% upside from current levels.

The stock has been trending upward, climbing over 37% in the past 90 days. It currently sits at the high end of its 52-week price range of $4.46-$7.51 and shows ongoing positive price momentum, trading above its 20-day (6.74) and 50-day (6.33) moving averages. The shares trade at a relative discount with a P/B ratio of 0.8x, half that of the Gold industry’s average of 1.74x.

Summary

Centerra Gold has been on an impressive trajectory against the backdrop of historically high gold and copper prices. The company’s cost advantage over its peers and substantial liquidity position is a winning combination. The stock shows positive momentum while trading at a relative discount, giving investors compelling reasons to consider adding CGAU to their portfolio.

Disclosure

Credit: Source link