(Kitco News) – Asset prices from precious metals to stocks and cryptos trended higher on Monday as investors brushed aside words of caution from policymakers and placed bets that an interest rate cut would come sooner than Fed officials have let on, sparking a rally across all asset classes.

The Dow briefly spiked above 40,000 while the Nasdaq touched a new intraday high to start the week, but the real story was in precious metals as Gold recorded a fresh all-time high while silver climbed to its highest level in over a decade.

“Two categories of investment have stood out in terms of performance in 2024: precious metals and cryptocurrencies,” said Neil Roarty, analyst at investment platform Stocklytics. “Both gold and Bitcoin (BTC) have hit all-time high prices this year, while silver, platinum, Ethereum and Solana have all performed strongly.”

“With gold topping $2,450 per ounce for the first time ever on Monday, and Bitcoin not far off its $72,000 high-water mark, the question for investors is whether these bull runs are sustainable,” Rotary said. “The answer might lie in how metals and cryptocurrencies are mined.”

“The cost of extracting gold from the ground has been rising steadily due to various factors, including disrupted supply chains and Russia’s invasion of Ukraine,” he noted. “Meanwhile, Bitcoin’s recent halving event reduced the rewards Bitcoin miners receive by 50 percent in April.”

“With political uncertainty and the promise of falling interest rates likely to sustain demand for both categories, the rising cost of supply should give the bulls of both camps reason to be optimistic,” he concluded.

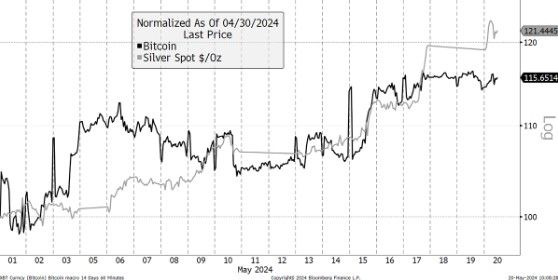

Addressing the rally in silver as it relates to Bitcoin, ByteTree analyst Charlie Morris noted, “Over the past couple of weeks, silver has rallied 21%, even beating Bitcoin despite the high correlation. Naturally, correlations come and go, but this one is interesting because crypto and commodities seem to be in sync.”

“In the long term, this is an important moment for silver because it has broken out above $30/ounce, which is a ten-year high,” they added. “Silver has tested $50 twice, in 1980 and 2011. The bulls, including myself, see $50 being retested. But is silver breaking out to an all-time high? We will have to wait and see.”

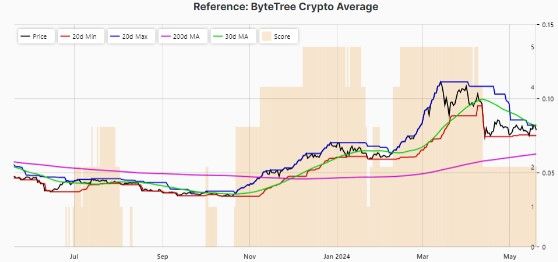

Morris said comparing Bitcoin to silver at this time is “relevant because crypto breadth remains weak, as shown by the cooled ByteTree Crypto Average (BCA). Few tokens are performing, and even Bitcoin has seen a slowdown in ETF flows.”

Morris concluded by saying that while he stands by previous Bitcoin predictions that it “will compound at 25% IRR this cycle into 2028, and the breakout will likely come in October, or Uptober,” currently, “The market has swung to commodities, and it’s silver’s turn. What should crypto investors do in the meantime? Remain patient.”

According to Ed Hindi, Chief Investment Officer at Tyr Capital, the crypto bull market has temporarily paused for consolidation, and prices will soon start to climb higher.

“We strongly believe that altcoins have yet to reach their full upside potential,” Hindi said in a note shared with Kitco Crypto. “We expect the increase in global liquidity and reallocation of profits generated in BTC to fuel the yet to come alt season.”

As for what will help reignite momentum, he pointed to ongoing debt printing and the return of loose fiscal policies as the inciting forces.

“Bigger drivers currently at play like increased global liquidity, loose fiscal policies, and persistent geopolitical tensions will likely push BTC past the $100k mark in 2024,” he said. “We expect Private banks and family offices to continue their BTC accumulation and start venturing further into the altcoin space as their customers get more confident with the asset class.”

And according to Markus Thielen, head of research at 10x, the resumption of the bull market may have already begun as “A breakthrough above $67,500 could potentially lead to new all-time highs, a scenario that our Bitcoin ETF model predicts.”

“Our 68,300 ‘line-in-the-sand’ is back in focus, as a move above could technically set off a strong rally,” Thielen said.

With Bitcoin trading at $69,672 at the time of writing, an increase of 5.2% on the 24-hour chart, the rally that Thielen predicted may already be underway. It remains to be seen if traders can keep the bullish momentum going once the minutes from the latest FOMC meeting are presented later in the week.

BTC/USD Chart by TradingView

At the closing bell, stocks finished mixed, with the Nasdaq and S&P gaining 0.65% and 0.09%, respectively, and the Dow losing 0.49%.

Altcoins rally higher

Altcoins utilized Bicoin’s momentum to stage rallies of their own, with all but a dozen tokens in the top 200 recording gains on Monday, and only five tokens seeing a loss greater than 2%.

Daily cryptocurrency market performance. Source: Coin360

Pyth Network (PYTH) led the gainers with an increase of 20.4%, followed by gains of 20.1% for Pendle (PENDLE) and 18% for Reserve Rights (RSR). DeXe (DEXE) was the biggest loser, falling 5.4%, while Chainlink (LINK) lost 2.2%, and 0x Protocol (ZRX) fell 2%.

The overall cryptocurrency market cap now stands at $2.55 trillion, and Bitcoin’s dominance rate is 54.1%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link