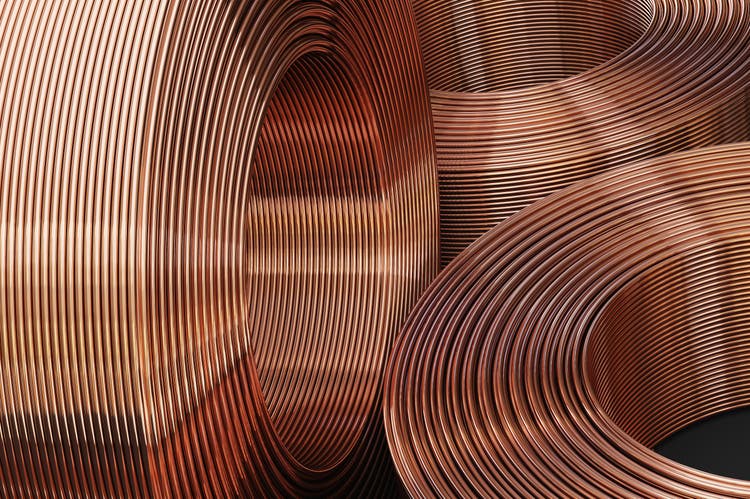

SimoneN/iStock via Getty Images

Freeport McMoRan (NYSE:FCX) +5% in early trading Wednesday after reporting better than expected Q4 adjusted earnings, as rising copper demand and higher gold prices more than offset lower than expected precious metals sales volumes.

Q4 net income fell to $388M, or $0.27/share, from $697M, or $0.48/share in the year-earlier quarter, and revenues rose 2.6% Y/Y to $5.91B

Q4 copper revenues rose 7% to 1.1B lbs, exceeding Freeport’s (FCX) October forecast, at an average price of $3.81/lb, slightly below $3.85/lb for FY 2023.

Q4 gold sales jumped 20% to 549K oz at an average price of $2,034/oz, compared with $1,972/oz for all of 2023, but gold sales by volume fell 5% short of an earlier estimate, which the company blamed on an export license issue at its Grasberg mine in Indonesia that has since been resolved.

For FY 2024, Freeport (FCX) forecast sales of ~4.1B lbs of copper, 2M oz of gold and 85M lbs of molybdenum, flat compared with 2023 but above last year’s totals for gold of 1.7M oz and molybdenum of 81M lbs.

For Q1, Freeport (FCX) guided for sales of 1B lbs of copper, 575K oz of gold and 20M lbs of molybdenum.

Credit: Source link