draganab/iStock via Getty Images

Preamble

Around a month ago, I penned Part 2 in this series in which various doom laden scenarios were laid out that could potentially boost the cost of buying the yellow stuff northwards. And as I type these words, the spot gold price remains above $2,300 an oz for some of the reasons outlined therein.

In this piece, a smorgasbord of gloomy developments are set out, all of which have the potential to hoist the demand for gold and thus provide a tailwind to the price. Having said that, some peculiar events have occurred, which, one would have thought, ought to have had the opposite effect, that is to say exert downward pressure on the price of gold. Two such situations that spring to mind are the persistently high interest rates and the curious phenomenon of the outflow of funds from Gold ETFs.

ETF Outflows

According to the March report from the World Gold Council, droves of Investors were dumping gold ETFs in February, and for the ninth month in a row. This global sell-off amounted to a sizeable $2.9 billion.

It would appear that North American investors were the biggest sellers, ditching a not inconsiderable $2.4 billion in gold ETFs. As to why this happened, despite a strengthening gold price, one can only guess. Maybe it was because they were feeling optimistic about the economy and the interest rates available on treasuries. After all, gold doesn’t pay interest and investors can buy treasuries that earn circa 5%.

In the April report, there was better news for gold investors. While money continued to flow out of gold ETFs globally for the 10th month in a row, the pace slowed significantly compared to previous months.

The total outflow in March was $823 million, much lower than February’s $2.9 billion and the average for the past nine months. Seemingly, North Americans started buying gold ETFs again, which offset some losses from other parts of the world. Since the price of gold remained strong, the total value of gold held in ETFs actually rose.

The April report hints at a potential positive shift in North American investor sentiment towards gold. For confirmation, I guess we will have to wait for the May report.

Geopolitical Woes

Gold fans need no reminding that typically geopolitical shenanigans provide support for precious metals. I’ve been around for a while and there seems to be more trouble spots around the world than you can shake a stick at, certainly more than I’m used to. There are the ongoing conflicts in the Middle East and Ukraine, the tensions involving China, and Russian troops replacing US soldiers in Niger.

Middle East

The current Middle East conflict certainly has the potential to push gold prices higher. One would expect that these clashes create anxiety about disruptions to oil supplies, which one would further expect to trigger a flight to gold.

However, the price of oil hasn’t risen so high, indeed the futures price currently stands at around $77.50 a barrel at time of writing. It seems to me that given the lack of panic about the supply of oil, the Middle East travails are unlikely to be driving the price of gold.

Ukraine

You would imagine that Russia’s recent tactical nuclear missile drills, suggesting Armageddon, would spark some interest in gold buyers. But no, the price per ounce failed to take out the highs of around $2,400.

The REPO Act

The Rebuilding Economic Prosperity and Opportunity for Ukrainians Act (REPO) was passed to the house in 2023 and Congress passed this controversial law in April. Coincidently, gold reached a high of around $2,400 per ounce, on Friday, April 12th, 2024.

It was expected that the EU would follow in lockstep with the US and snaffle Russian assets in the order of $300 billion. And I reckon they would have done were it not for the intervention of China, Saudi Arabia and Indonesia. Whilst those in the West may consider commandeering Russian cash worthy, countries outside of the collective west are likely to go all wobbly and start moving their dough elsewhere, maybe into gold, if this action is carried out.

Now that this particular threat has subsided, gold is now hovering around $2,300. Although, it was reported on 9th May that the EU has decided to use the profits generated by Russian assets to fund Ukraine’s war efforts. Now we must wait for the reaction of the rest of the world to these developments. I suspect that gold will get a nice lift as countries contemplate the risks involved in parking their cash in Western banks.

Gold Repatriation

For decades, countries all over the globe have felt comfortable in keeping their gold reserves in London and the US. However, Reuters reported in July 2023 that; “An increasing number of countries are repatriating gold reserves as protection against the sort of sanctions imposed by the West on Russia, according to an Invesco survey of central bank and sovereign wealth funds.”

In December 2019, it was noted that many countries were moving their gold to safes within their borders. Countries as diverse as, Belgium, Switzerland, Austria, India, Mexico, Thailand, Sri Lanka, and Bolivia and Bangladesh. To quote; “Amid international financial instability and uncertainty of the future of the Eurozone, other nations have also set forth a gold repatriation program.”

This trend does not appear to be slowing. We have Nigeria requesting their gold be transported from US vaults to theirs. The president of Ghana has gone on record to suggest that 30% of the African continent’s reserves be shipped back.

Reduced supply in the London and US markets may have led to a price increase. London and the US are major gold trading hubs, and a significant reduction in the amount of gold stored there could tighten supply and drive-up prices.

Central Banks

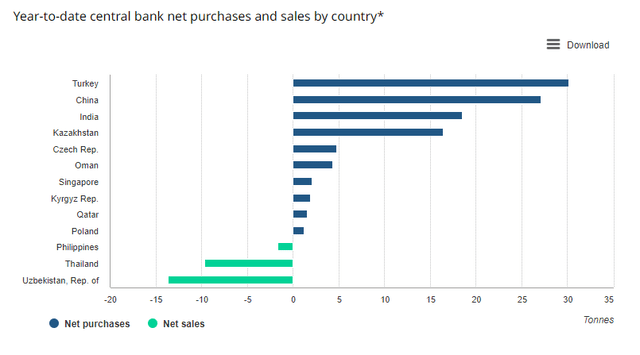

According to the April report by the World Gold Council, central banks around the world are showing a strong and continued interest in buying gold. This year started with the highest first quarter of gold buying on record, surpassing even the high levels seen in 2022 and 2023. This trend is being driven by central banks in emerging economies, particularly China, Turkey, and India. China, for instance, continues to add to its gold reserves, reaching a 17-year high in monthly purchases.

Central Bank purchases of gold (World Gold Council)

This surge in central bank buying has probably contributed to the move up in the overall gold price. It’s also led to an increase in the share of gold that central banks hold in their total reserves. There was some minor selling by a few central banks, but this paled in comparison to the major buying.

Looking ahead, analysts expect central banks to keep buying gold, providing important support for the gold market. The recent rise in gold prices might have slowed down some buying activity, but it’s not expected to derail central banks’ long-term plans to accumulate gold.

Chinese Retail

Chinese consumers have begun hoarding gold as their confidence in traditional investments such as real estate or stocks has faltered. Now that the population of around 1.4 billion has a considerable number of middle-class consumers, this trend in the demand will certainly provide a tailwind to the price per ounce.

Summary

There are several factors that could increase the demand for gold, potentially raising the price. There are the obvious geopolitical tensions, rising interest rates, central bank buying, and gold repatriation that have the potential to increase the price.

Credit: Source link