(Kitco News) – If you told investors in September of last year that by the end of 2023, the gold price would be closing higher than the year, many would have dismissed it out of hand. At the time, gold was trading in the $1,640 range, well off its highs following the Russian invasion of Ukraine, and high interest rates were providing additional headwinds for the precious metal.

Well, interest rates rose even higher this year, but spot gold still managed to finish the final trading day of 2023 trading at $2,063.45 at the time of writing, with many analysts predicting hundreds more in gains during the year to come.

Veteran trader CEO Technician noted in a post on X that gold had a solid year.

#Gold quarterly candlestick chart – the year has officially drawn to a close in futures land and the numbers say gold rose 13.5%📈in 2023. pic.twitter.com/Q5N07SHHaA

— CEO Technician (@CEOTechnician) December 29, 2023

Kevin Wadsworth of NorthStarCharts hearkened back to those September 2022 doldrums to reflect on how far the precious metal has come, and why he was so confident in his bullish predictions.

When gold was $1600, why was I so confident we were more likely to head to $2500+ than $1500 or less?Evidence, evidence, evidence. Ignore narratives & fairytales (the US Dollar IS NOT the strongest currency – the swiss Franc has crushed it for over 50 years) #Gold #Silver pic.twitter.com/p4ORRWgeHj

— Northstar (@NorthstarCharts) December 29, 2023

In another post, he shared an annual chart showing gold breaking to the upside ahead of 2024. “This will be gold’s highest yearly close EVER,” he wrote.

Gold – Breakout on 12-month candle chart. This will be golds highest yearly close EVER #preciousmetals #silver #gold pic.twitter.com/EgNy2jqXfg

— Northstar (@NorthstarCharts) December 29, 2023

And all of this comes ahead of what should be a very strong start to the new year, if history is any indication.

According to analysis by the World Gold Council, gold tends to perform very well in the first month of the year, posting an average return of 1.79% in January since 1971, nearly three times the precious metal’s long-term monthly average.

“This doesn’t mean that gold prices rise every January,” the WGC said. “There’ve been several years when it hasn’t, most recently in 2021 and 2022. Years with negative returns in January generally coincided with periods when the US dollar has strengthened – often significantly.”

But with the greenback seeing a recent pullback, and with rate cuts and treasury yields set to fall in the new year, January is shaping up to be one of the strong ones.

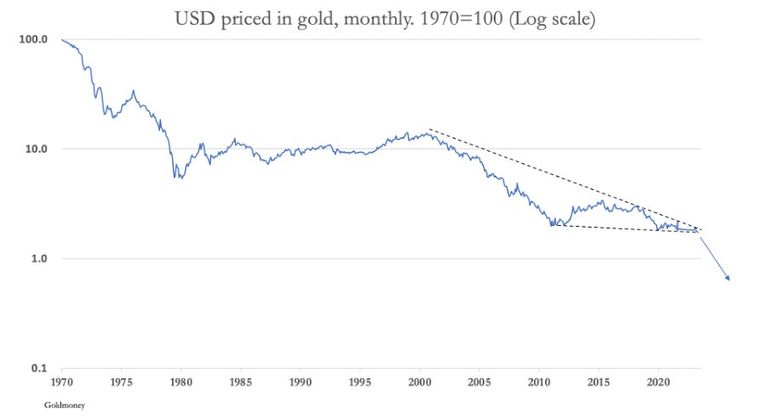

Alastair MacLeod, Head of Research for Goldmoney and SchiffGold, shared the following chart summarizing his perspective on gold’s likely trajectory in 2024. “It puts the price relationship in the right perspective!” he said.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link