manassanant pamai

Introduction

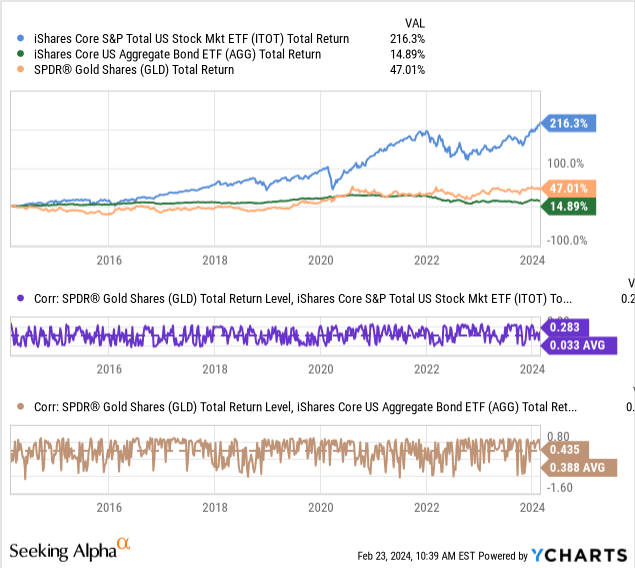

Gold is one of the largest alternative assets investors across the world hold, and is commonly held because its returns do not match those of stocks and bonds, giving extra diversity and stability to traditional portfolios.

Choices, Choices

There are dozens of choices of ETFs that investors could buy into that effectively translate into the same strategy: buy and hold physical gold.

There are also dozens of differences between these funds, and investors shouldn’t make an uninformed decision on which ETF they pick, as it may impact their long term returns. In this article, I am going to explore the most popular gold funds to determine which one is the best investment option today.

I am going to cover the following ETFs:

- SPDR Gold Shares (GLD)

- iShares Gold Trust (IAU)

- abrdn Physical Gold Shares ETF (SGOL)

- GraniteShares Gold Trust (BAR)

- VanEck Merk Gold Trust (OUNZ)

- Goldman Sachs Physical Gold ETF (AAAU)

- Sprott Physical Gold Trust (PHYS)

Overview

These seven ETFs were chosen because they are the most popular gold ETFs. More exist, notably including mini versions of ETFs listed here like GLDM and IAUM, but I’ve focused on these seven to keep this already massive comparison “brief.”

Because the basic strategy of all of these funds is the same, simple info like assets under management and expense ratios matter a ton.

| Ticker | GLD | IAU | SGOL | BAR | OUNZ | AAAU | PHYS |

| Inception | 11/2004 | 01/2005 | 09/2009 | 08/2017 | 05/2014 | 07/2018 | 02/2010 |

| AUM | $54.06B | $25.39B | $2.68B | $0.92B | $0.78B | $0.59B | $6.46B |

| ER | 0.40% | 0.25% | 0.17% | 0.17% | 0.25% | 0.18% | 0.41% |

| Stdev* | 14.43% | 14.37% | 14.38% | 14.29% | 14.35% | 14.37% | 15.42% |

| Beta (5yr) | 0.24 | 0.24 | 0.24 | 0.24 | 0.23 | 0.23 | 0.15 |

| CAGR (5yr) | 9.06% | 9.22% | 9.31% | 9.31% | 9.19% | 9.30% | 8.69% |

*Annualized Standard Deviation

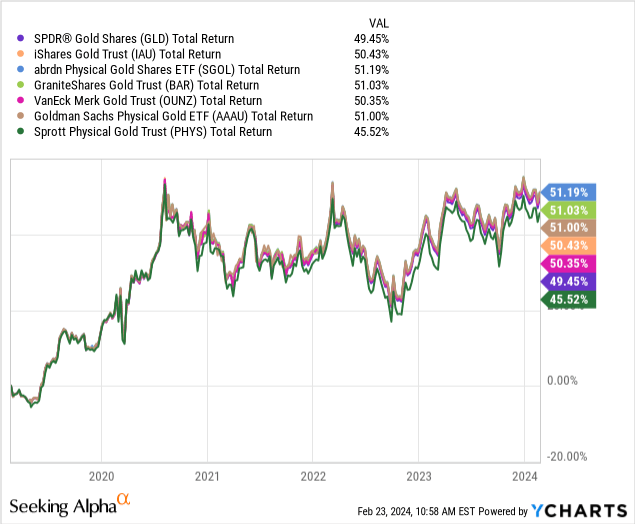

Here’s how they have performed over the last five years.

Here are the major highlights:

- GLD is the oldest fund, and has over x2 the AUM of the next closest fund, IAU, and 100x the lowest AUM fund, AAAU

- SGOL & BAR tie for lowest expense ratio of 0.17%, with an honorable mention to AAAU at 0.18%

- PHYS has a significantly different (and lower) beta than the other funds, making it the best “diversifier” in terms of correlated returns

- PHYS also carries the lowest CAGR at 8.69%, with the other funds all ending in a very tight range between 9.06% — 9.31%

Two Winners Emerge

The most notable standouts from the table above are the abrdn Physical Gold Share ETF (SGOL) and the GraniteShares Gold Trust (BAR).

Both carry an extremely low ER, especially compared to the fan-favorite GLD, comparing their 0.17% to GLD’s 0.40%. This discrepancy has led to a higher 5yr compound annual growth rate for both funds compared to GLD. In a market where each fund’s strategy is functionally the same, these little differences add up. An extra 25bp annually for any investment is nothing to sneeze at, and something that warrants deep consideration for investors who may otherwise default to the highest AUM fund of the lot.

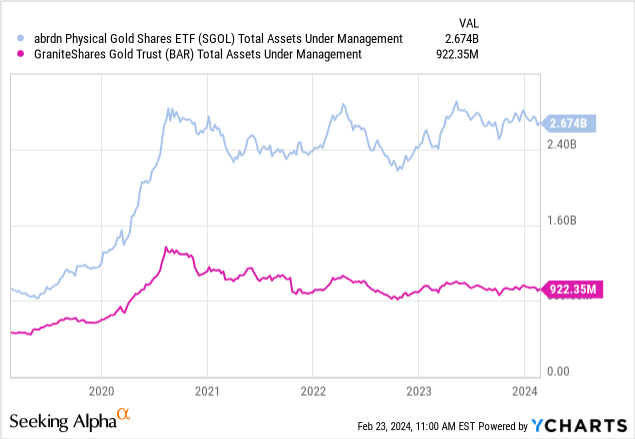

While both SGOL and BAR have vastly lower AUM counts than GLD or IAU, they are both run by established ETF providers and face little risk of closure at the current moment. Gold typically does not have sudden drawdowns, which is a major consideration for most potential fund closures.

Of course, investors who require liquidity in excess of what these funds provide will always be better off with GLD, as it’s the largest, most liquid pure-gold fund on the market.

Winner: abrdn Physical Gold Shares ETF (SGOL)

This is my pick for gold exposure, as it checks all of the boxes we’ve set out.

Among its competition, it has:

- The lowest expense ratio.

- The highest CAGR.

- An average standard deviation.

- An average beta.

- Enough liquidity for the average investor.

These factors highlight why it would be less risky to invest in gold via SGOL than funds that underperform due to higher ERs like GLD and PHYS, as they carry a lower CAGR due to those fees.

SGOL wins over BAR for the simple reason that it carries far more AUM and has almost identical characteristics. When in doubt, go with the bigger fund.

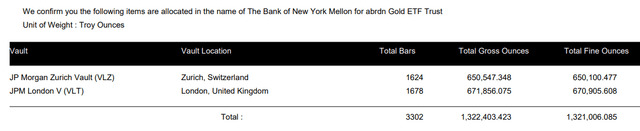

SGOL stores physical gold bars in bank vaults in London and Zurich, where they are audited by Inspectorate International twice a year, including one annual random audit.

JPMorgan Chase Bank (JPM) acts as the custodian for the fund with The Bank of New York Mellon (BK) acting as the trustee.

Figure 2 (J.P. Morgan)

The list of bars is updated daily and can be found here and the “literature” section.

Conclusion

There are a ton of pure-gold funds available to investors, so screening the fund’s fundamentals is important in fund selection. When the underlying strategy of all of these funds is effectively the same, all that is left to determine the superior investment choice is the fund’s performance against its competitors.

SGOL receives my approval here as the “best in class” of pure-gold ETFs due to its over $2B AUM, tiny ER compared to the industry standard, GLD; and transparency regarding reporting, accounting, and storage of its assets.

BAR receives an honorable mention for its similarly low ER, which also translated into increased CAGR over funds with higher ERs, its sub $1B AUM makes it a poor investment choice compared to SGOL at the current moment.

If BAR’s AUM were to overtake SGOL’s, I may consider revising my decision. Until then, SGOL will remain my “gold standard” of this class of ETFs.

Thanks for reading.

Credit: Source link