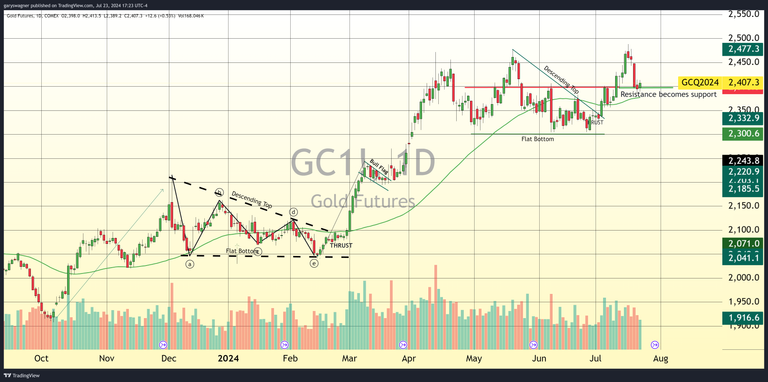

Gold futures rebounded strongly on Tuesday, with the most active August contract reclaiming the $2,400 per ounce mark as traders positioned themselves ahead of crucial economic data releases. This resurgence follows Monday’s retreat, which saw gold settle at $2,394.70, just shy of the psychologically significant $2,400 mark.

As of 5:05 PM ET, August gold futures were trading at $2,409.10, representing a notable gain of $14.40 or 0.61%. This upward trajectory occurred despite mild headwinds from a strengthening US dollar, which advanced 0.14% to 104.424 on the dollar index.

Multiple factors continue to influence gold prices, with ongoing purchases by central banks worldwide playing a role. However, the primary catalyst appears to be renewed optimism surrounding the Federal Reserve’s potential pivot towards interest rate normalization, with high expectations for an initial rate cut in September.

Market focus has now shifted entirely to upcoming economic reports. Thursday’s release of U.S. GDP data for the second quarter and Friday’s Personal Consumption Expenditures (PCE) index are particularly anticipated. The PCE index, the Fed’s preferred inflation gauge, is expected to show further contraction in inflation. Consensus

estimates project an annualized rate of 2.5% for last month, down from May’s 2.6%.

A recent Reuters poll suggests that a growing majority of economists foresee two rate cuts by the Federal Reserve this year. While the July Federal Open Market Committee (FOMC) meeting is unlikely to bring rate changes, with the CME’s FedWatch tool indicating a 97.4% probability of rates remaining steady, the outlook for September is

rapidly evolving.

The likelihood of a September rate cut has increased significantly. The probability of no cut has fallen to 3.9%, down from 7.7% just a day earlier. Expectations for a quarter-point cut have surged to 93.6%, up from 88.5%, while the chance of a half-point cut has decreased to 2.5% from 3.8%.

If these economic projections prove accurate and optimism continues to build around two potential rate cuts this year, gold prices could move towards last week’s record levels. The precious metal achieved a new record close last Tuesday and an all-time high on Wednesday.

Interestingly, Sunday’s unexpected announcement by President Biden to withdraw from the presidential race has had minimal impact on financial markets, including gold.

Traders seem to have swiftly incorporated this development into their calculations, maintaining their focus on economic indicators and monetary policy expectations.

As the week unfolds, market participants will closely monitor the upcoming economic reports for further insights into the Fed’s future actions. The gold market’s resilience in the face of dollar strength and its quick rebound above $2,400 underscore the metal’s current appeal as both a safe-haven asset and an inflation hedge.

For those who wish to learn more about our service, please go to the links below:

Information, Track Record, Trading system, Testimonials, Free trial

Wishing you as always good trading

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link