Newmont Corp. (NYSE:NEM), the world’s largest gold miner, saw its share price spike 13% on Thursday after the Denver-based company posted stronger-than-expected earnings.

This ignited a broad-based rally in the gold mining industry, despite the overall weak investor sentiment elsewhere.

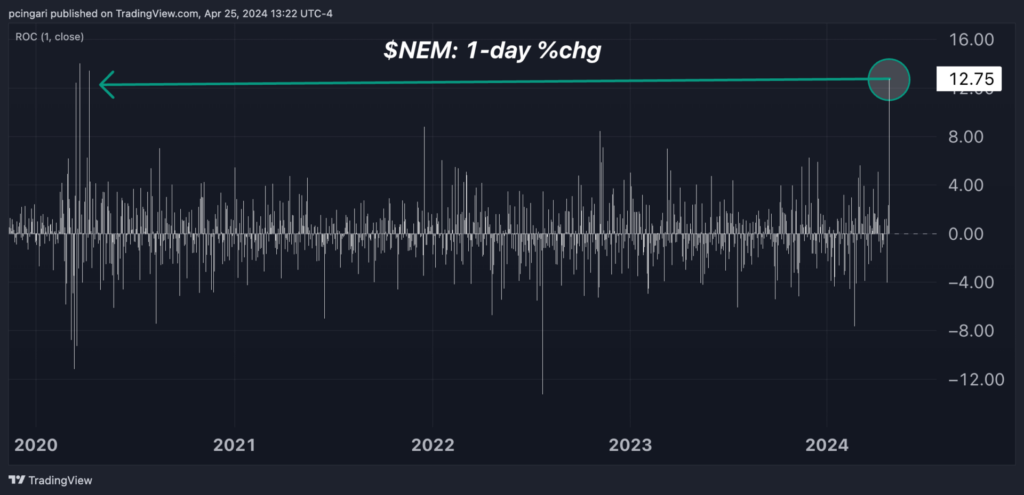

Newmont is currently on track to achieve its best-performing session since April 2020, when the mining giant rallied following a major volatility event due to the Covid-19 pandemic.

Chart: Newmont Eyes Top-Performing Session Since April 2020

Newmont Sharply Beats Estimates, Declares First Quarter Dividend

- Newmont reported earnings per share (EPS) of $0.55 in Q1 2024, marking a 38% increase from the corresponding quarter of the previous year and surpassing Street’s consensus estimates of $0.36 by a significant 54%, according to Benzinga Pro platform.

- Revenue for the quarter amounted to $4.02 billion, indicating a 50% rise from Q1 2023 and surpassing forecasts of $3.66 billion by a noteworthy 10% margin.

- Newmont delivered $288 million in dividends to shareholders and declared a dividend of $0.25 per share of common stock for the first quarter of 2024.

- Newmont reported gold Costs Applicable to Sales (CAS) per ounce of $1,057 and gold All-In Sustaining Costs (AISC) per ounce of $1,439, both notably lower than the average realized gold price of $2,090 per ounce. This stark contrast indicates wide profit margins for the company.

- “Newmont delivered a strong first quarter operational performance, producing 2.2 million gold equivalent ounces and generating over $1.4 billion in cash from operations before working capital changes,” Tom Palmer, Newmont’s president and CEO, stated.

See Also: Why Gold Miner Newmont Shares Are Surging Today

Gold Miners Rally In Response To Newmont’s Results

Newmont’s remarkable Q1 earnings report catalyzed a significant rally in gold mining stocks, drawing investors to the industry in anticipation of potentially positive results from other players.

Additionally, miners showed a positive response to the rise in gold prices, with the precious metal gaining 0.7% to $2,330 per ounce, buoyed by escalating stagflationary worries triggered by the latest gross domestic product report.

The VanEck Gold Miners ETF (NYSE:GDX) rose 3.1%, while junior gold miners, as tracked by the VanEck Junior Gold Miners ETF (NYSE:GDXJ) rose 1.8%.

The top-performing North American gold miners on Thursday included:

| Name | 1-Day % | Market Cap |

| Newmont Corporation | 13.06% | $ 50.54B |

| Buenaventura Mining Company Inc. (NYSE:BVN) | 6.75% | $ 4.30B |

| DRDGOLD Limited (NYSE:DRD) | 4.73% | $ 705.14м |

| AngloGold Ashanti plc (NYSE:AU) | 4.29% | $ 9.57B |

| Coeur Mining, Inc. (NYSE:CDE) | 3.52% | $ 1.88B |

| K92 Mining Inc. (NYSE:KNT) | 2.69% | $ 1.31B |

| OceanaGold Corporation (NYSE:OGC) | 2.31% | $ 1.61B |

| Calibre Mining Corp. (NYSE:CXB) | 2.19% | $ 1.07B |

| Royal Gold, Inc. (NYSE:RGLD) | 1.91% | $ 8.12B |

| Agnico Eagle Mines Limited (NYSE:AEM) | 1.90% | $ 32.36B |

Now Read: Equinox Gold Snaps Up Greenstone Gold Mines For $995M In ‘Incredibly Rare’ Deal

Image: Shutterstock

Credit: Source link