(Kitco News) – Because gold prices do such a good job of anticipating future changes to inflation and interest rates, investors banking on a big rally for the yellow metal as the Fed cuts rates in 2024 may be in for a letdown, according to Erik Norland, Executive Director and Chief Economist at CME Group.

“Gold is often touted as an inflation hedge, but is that truly the case? Gold’s rally from 2001 to 2011 coincided with stable core inflation of around 2%. By contrast, from 2021 to 2023 when the U.S. economy experienced the steepest surge in inflation since the late 1970s and early 1980s, gold prices barely budged,” Norland said. “So, if not inflation, what really drives gold? And what should investors expect in 2024 and 2025?”

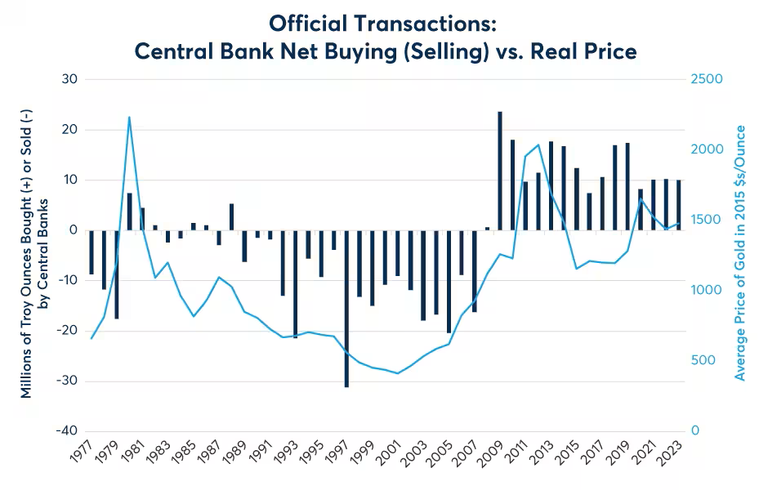

Norland said that one of the factors that will continue to impact gold prices in 2024 is buying by central banks, “which appears to move prices over the longer term.”

“[T]he world’s central banks clearly view gold as a currency – or at least a reserve asset – and since the global financial crisis (GFC), they have been buying more and more of it,” he said “Many years of near-zero or even negative interest rates set by central banks combined with quantitative easing (QE) and various sanctions regimes led many central banks to favor gold over central-bank-issued currencies. Neither the recent uptrend in rates nor the reversal of QE appear to have assuaged those concerns.”

Norland said that central banks’ gold buying since 2008 reversed the long period from 1982 to 2007 when they were steady net sellers. “This implies that pre-GFC central bank policy entrusted fiat currencies like the U.S. dollar, euro, yen, pound and Swiss franc as reserve assets more than gold. This relationship reversed since the GFC,” he said. “By all accounts, that tendency continued in 2023 despite central bank rate increases boosting returns on fiat currencies to their highest levels since 2007.”

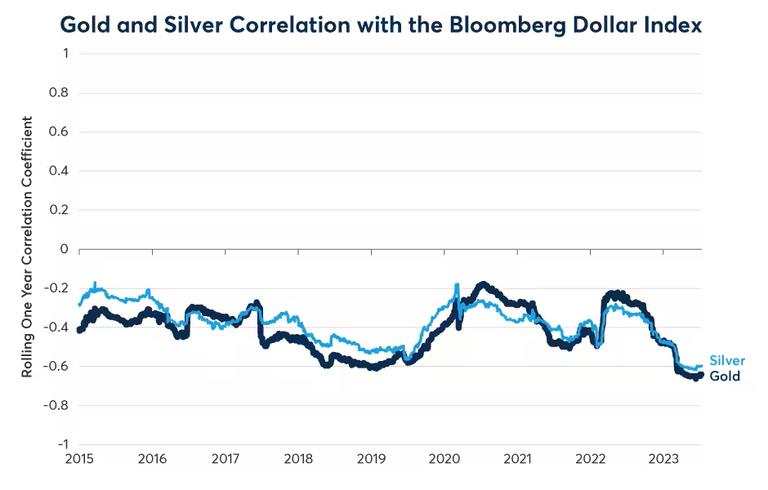

Norland said traders are also treating gold as a currency. “Strong and consistently negative correlations between gold and the Bloomberg Dollar Index (BBDXY) suggest that traders also see gold as an alternative to the U.S. dollar, not entirely unlike the currencies in Bloomberg’s Dollar Index such as the euro and yen,” he said.

Because precious metals pay no interest, “gold prices are typically averse to the prospects of higher rates,” he said. “This, along with the strength of the U.S. dollar in 2021 and 2022, is likely what kept a lid on gold prices” as the Fed raised rates from zero all the way to 5.375%.

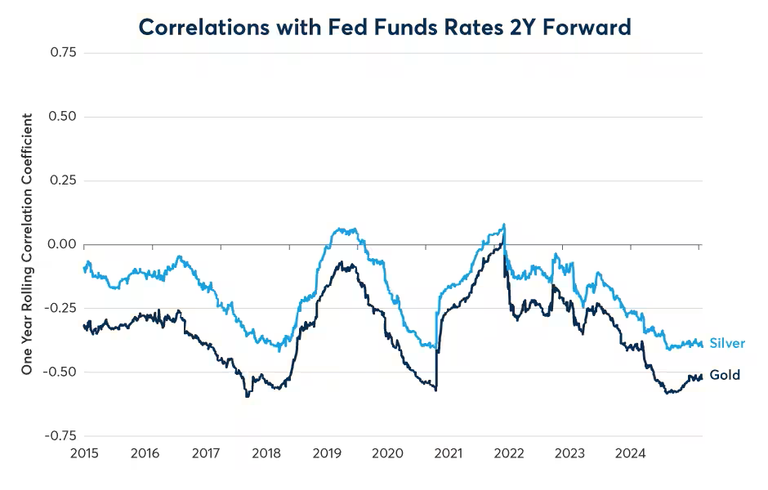

“Since 2015, gold prices have almost always had a strong negative correlation with the daily change in Fed funds futures two years forward.”

Norland said that even though gold didn’t see an inflation-induced rally from 2021-2023, it still performed as a good inflation hedge, only it anticipated the coming inflation rather than reacting to it.

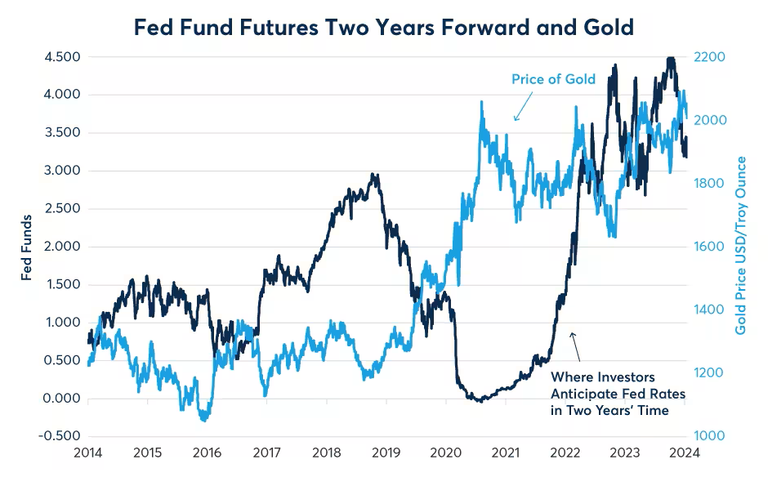

“Between October 2018 and June 2020, Fed funds futures went from pricing Fed funds two years forward at 3% to nearly zero. During this time, gold prices rose from $1,200 to $2,080 per ounce, a 73% rally,” he noted. “However, when inflation arrived in 2021 and strengthened in 2022, it wasn’t great news for gold because it caused investors in short-term interest rates (STIRS) to re-evaluate their expectations for long-term Fed rates from 0% to 4.5%. So, while inflation may have lifted gold prices higher, the prospect (and later reality) of higher rates, pushed gold prices back down.”

Norland said that gold’s rally to new all-time highs in December is another example of the precious metal anticipating rather than reacting, this time to the prospect of falling rates through 2024 and 2025.

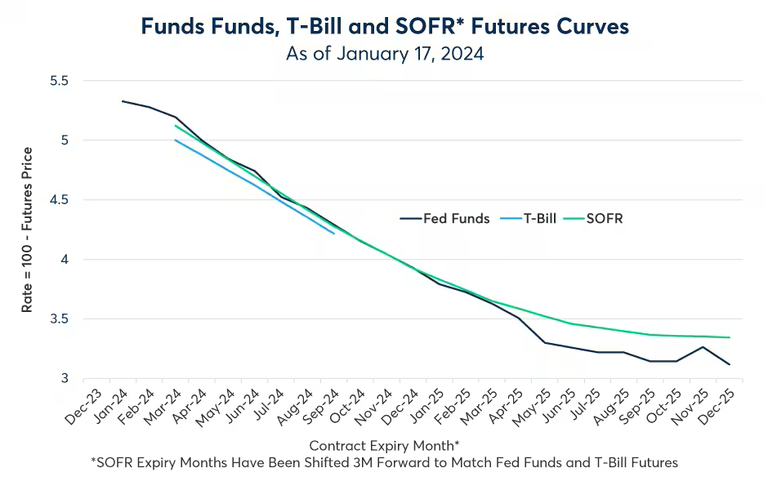

“[T]he Fed suggested in its ‘dot plot,’ a sort of internal forecast among members of the Federal Open Market Committee (FOMC), that it was seeking to cut rates by 75 basis points (bps) in 2024,” he said. “Fixed-income markets, however, are pricing for something much more dramatic, that is, for the Fed to cut rates by around 200 bps, with the first rate cut potentially coming as early as the Fed’s March meeting.”

Norland cautioned that because gold prices have done such a good job of anticipating and pricing in future changes to inflation and interest rates, it creates a risk for gold investors moving forward, as the reaction-based gains may not be there.

“For rate cuts to benefit gold, they may have to exceed the 200 bps that Fed funds futures are already pricing,” he said, “meaning the Fed may have to cut rates to below 3% by mid-2025 in order to keep the gold rally going.”

Norland said that with so much of the rate cuts already reflected in today’s gold price, the real driver through 2025 might be the performance of the U.S. economy itself. “A ‘soft landing’ with minimal rate cuts along the lines of the 75 bps suggested by the Fed’s dot plot may prove bearish for gold,” he said. “By contrast, an economic downturn accompanied by more rate cuts than currently expected might send gold to new record highs.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link