(Kitco News) – Gold appears overbought and due for an imminent correction, while silver is seeing support from both the investment community and industrial demand, according to precious metals analysts at Heraeus.

In the company’s latest report, the analysts noted that gold prices are continuing to rise despite the fact that rate cut expectations have been moderating.

“The gold price has risen by 12.6% year-to-date, and this is without the aid of a Fed monetary policy pivot, a markedly weaker dollar, or a meaningful resurgence in institutional investment demand via ETFs,” they wrote. “This may leave the door open to a move even higher later in the year when the Fed finally decides to drop interest rates, which in all likelihood will weaken the US dollar.”

They pointed out that gold prices have appreciated by nearly 4.7% in the last two weeks, even as Fed speakers have been working overtime to talk down frothy markets. “Although Jerome Powell’s words in a speech last week maintained the same message of data dependency and a cautious approach to making cuts to interest rates, swaps markets are still pricing in three cuts to the Federal Funds Rate by year-end (down from six at the start of the year), with a cumulative interest rate reduction of ~75 bp,” they said.

“Gold’s upward momentum has been strong, and a period of sustained downward pressure is unlikely,” they said, but added that “the risk of a counter-trend movement is rising,” as open interest in gold futures “appears to have peaked” and in their view, gold is now overbought.

“When [it] is at these extremes, gold typically experiences a pullback in the short term,” they said.

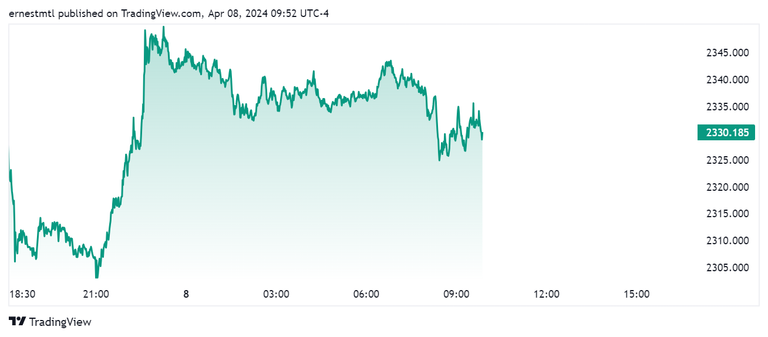

Spot gold continued to show strength on Monday after setting a new all-time high of $2,354.15 per ounce overnight. It has since pulled back to $2,330.10 per ounce, flat on the session at the time of writing.

Turning to silver, the Heraeus analysts said that the gray metal appears to be rising on the back of the strong performance of other metals of late.

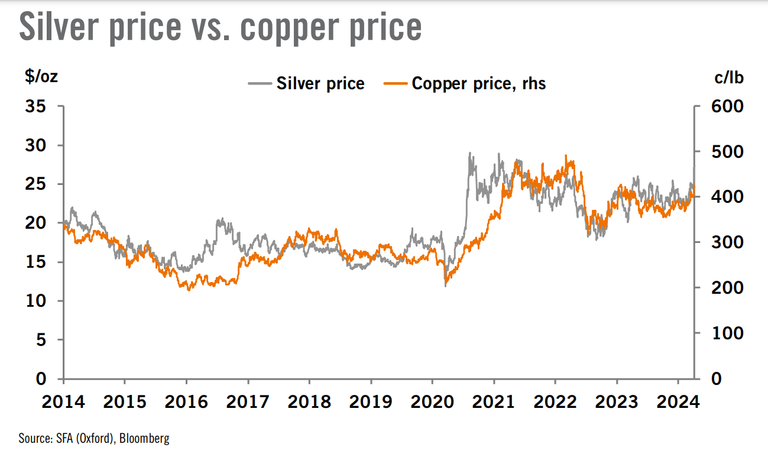

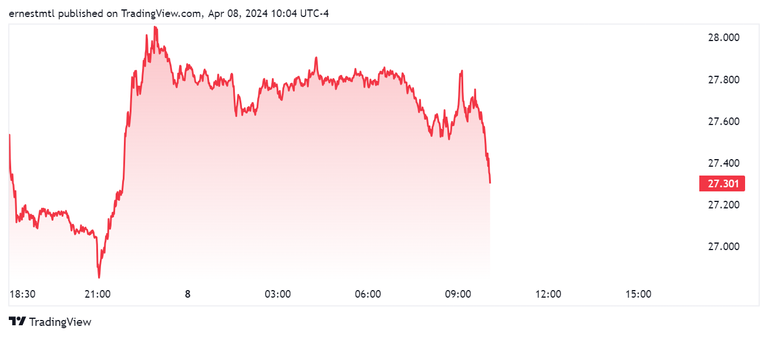

“The price of silver rose above $27/oz last week after having struggled relative to gold over the past two months,” they wrote. “Silver appears to have benefitted from both the investment/consumer and industrial demand sectors, each making up ~50% of total silver demand. The copper price has risen steadily thanks to concerns over tightening supply. Where copper goes, silver tends to follow.”

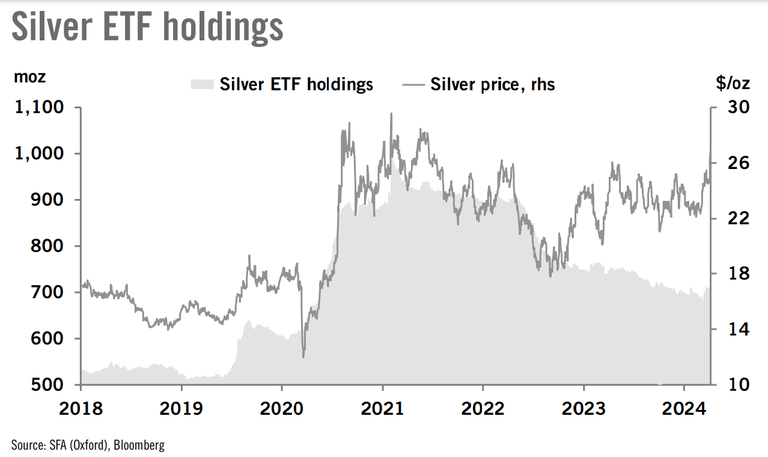

“Silver is a higher beta commodity than gold, so if retail investors show more interest as ETF holdings rise then it could outperform gold,” they noted. “Additionally, and in contrast to the gold market, silver investors re-entered the market for ETFs, with 10.7 moz of inflows in the last fortnight, taking total silver ETF holdings 3% higher year-to-date at 724 moz.”

The analysts said that industrial demand for silver is also expected to rise this year, based on “recent strong manufacturing data from the US and China” in addition to burgeoning Chinese solar installations.

Spot silver also saw a run-up above $28 per ounce in overnight trading, but it has since followed gold prices lower, last trading at $27.301 per ounce, down 0.48% on the session.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link