The price of gold has performed remarkably so far this year. To date, the value of the precious metal has increased by 12.58%, rising from $1,970 per ounce at the beginning of the year to $2,219 per ounce this week.

According to Bank of America’s latest report, gold could reach $3,000 in the next 12-18 months. Expectations of changes in the monetary policies of major central banks, the slow decline and control of inflation, and the ongoing demand as a safe-haven asset amid current geopolitical uncertainty are some of the reasons for its rise.

“We believe gold can reach $3,000 an ounce in the next 12-18 months, although current flows do not justify that price level for now. Achieving this would require non-commercial demand to increase from current levels, which in turn would need a reduction in the Fed’s rate. A flow into physically-backed ETFs and an increase in LBMA clearing volumes would be an encouraging first sign. Continued central bank purchases are also important, and a push to reduce the proportion of dollars in currency portfolios is likely to trigger more gold purchases by central banks,” states Bank of America in its latest report.

According to James Luke, a fund manager specializing in commodities at Schroders, gold has easily surpassed previous all-time highs and is currently trading above $2,300 an ounce, despite nearly uninterrupted sales by Western investors during 2023 and 2024. “Western liquidations have been offset by central bank, investor, and household purchases in the East. This shifting dynamic has been led by China but has not been limited to that country; demand increases have also occurred in the Middle East and elsewhere,” he notes.

Gold Equities

In his view, geopolitical and fiscal fragility today combine to forge a path toward a sustained and multi-faceted global push for gold supplies. “In our opinion, this could trigger one of the strongest bull markets since President Nixon closed the gold window in November 1971, ending the convertibility of the US dollar into gold,” adds Luke.

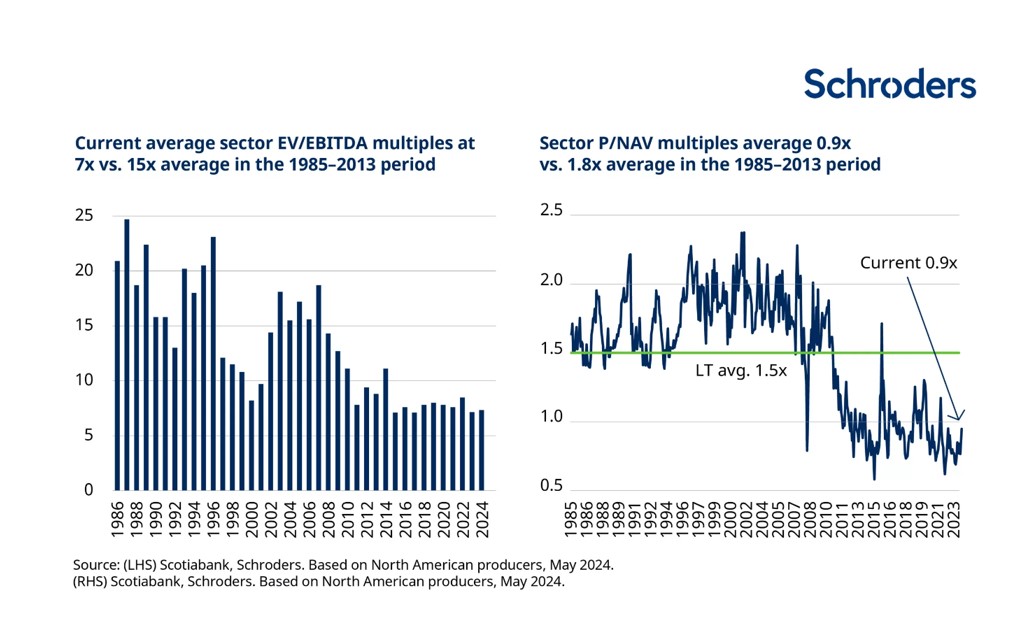

One nuance the Schroders manager adds is that, although gold prices have risen, gold equities have lagged behind the price of bullion. Luke explains that despite solid financial fundamentals driven by this gold bull market led by the East, valuations are nearing 40-year lows due to the poor Western view of gold and the poor operational results of some sector “leaders.” What could change this situation?

“It is no exaggeration to say that the gold mining sector could rise by 50% and still seem cheap. With a total market capitalization of $300 billion, the gold equity sector has been largely ignored, but we believe that is about to change. If there has ever been a time to include gold equities in a multi-year precious metals allocation, we believe it is now,” he explains.

Central Banks, Demand, and Gold

A relevant factor in the evolution of the gold price is the demand from central banks. According to BofA in its report, “encouragingly,” the latest World Gold Council Central Bank Survey confirmed that monetary authorities are looking to increase their gold purchases. “Long-term store of value/inflation hedge, performance during times of crisis, effective portfolio diversifier, and default risk absence make gold attractive. Although central banks’ motivations for holding gold may vary, they tend to have something in common: the proportion of dollars in their portfolios has been decreasing,” the entity notes.

In this regard, it adds that central banks have had various reasons for reducing their proportion of dollars, “including the realignment of currency denominations in reserves with the currencies with which countries actually trade and moving towards a multipolar world.”

Specifically, central banks—China, Singapore, and Poland, the largest in 2023—have been listening, although record purchases have only increased gold reserves from representing 12.9% of total reserves at the end of 2021 to 15.3% at the end of 2023.

When discussing gold demand, Luke notes that it is increasing among Chinese investors as the luster of the real estate sector fades. “Chinese households, who added trillions to a record excess savings in 2022 and 2023, are one of those players. The end of the thirty-year real estate bull market has been key to triggering a massive shift in attitude towards gold. The increase in investor preference for gold has mirrored the decline in the real estate sector. We doubt that the increased gold demand from households is a temporary phenomenon,” he argues.

Polarization and Gold

Finally, the Schroders manager highlights that the strength of gold reflects the shift towards a more polarized world, making it stronger as a safe-haven asset. Undoubtedly, the tightening tension between the United States and China, and the sanctions imposed on Russia following the invasion of Ukraine in 2022, have driven record central bank gold purchases as a monetary reserve asset.

“From a long-term perspective, central bank purchases well reflect the evolution of global geopolitical and monetary/fiscal dynamics. Between 1989 and 2007, Western central banks sold all the gold they practically could, as they were limited by the gold agreements reached by central banks to maintain order in sales after 1999. In that post-Berlin Wall and Soviet Union world, where US-led liberal democracy was booming, globalization was accelerating, and US debt indicators were frankly quaint compared to today’s, the demonetization of gold as a reserve asset seemed entirely logical,” argues Luke.

In his opinion, the more than 1,000 tons of gold (20% of global demand) bought by central banks in 2022 and 2023, a pace that continued in the first quarter of 2024, is potentially seismic. It seems entirely plausible that the current tense dynamic of established power/emerging power, combined with fiscal fragility looming not only over the US-issued reserve currency but over the entire developed economic bloc, could trigger a sustained move towards gold. “Bluntly put, the gold market is not large enough to absorb such a sustained move without prices rising significantly, especially if other global players also try to enter more or less at the same time,” concludes the Schroders manager.

Credit: Source link