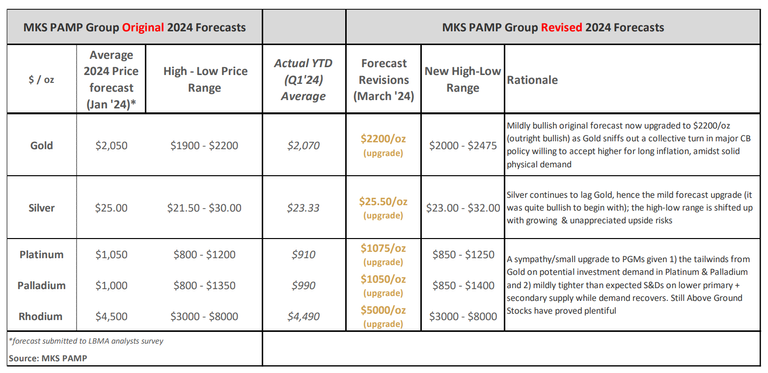

(Kitco News) – The first quarter of 2024 was all about gold, according to an updated outlook from MKS Pamp. “We were not bullish enough Gold in Q1’24 and were too bullish Silver and Platinum,” the analysts said, “but the relative outperformance between Gold and the white metals (Silver & PGMs) should compress in Q2’24 & Q3’24.”

In their recently published Precious Metals Outlook 2024 – Revised Forecasts, the Swiss precious metals giant broke down the sector’s performance in detail, and laid out their adjusted predictions for the remainder of the year.

The analysts wrote that gold has shown sensitivity to central banks’ tolerance of higher rates to address sticky inflation.

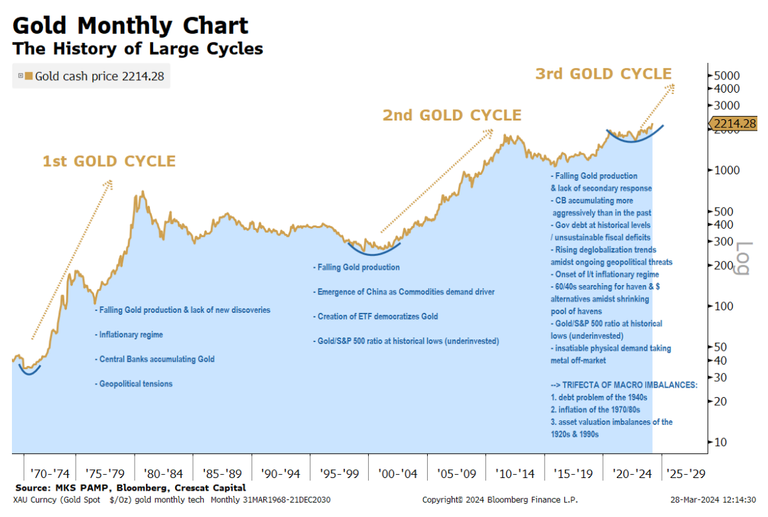

“Original Forecast $2050/oz (mildly bullish vs the street) is now upgraded to $2200/oz (outright bullish) as Gold sniffs out a collective turn in major CB policy willing to accept higher for long inflation, amidst solid physical demand,” they wrote. “Our original 2024 forecast published in January was $2050/oz (high-low range of $1900-$2200/oz), hinging on the Fed cutting rates as the global economy slowed. We also expected new all-time highs. So far Gold has already taken out our high price forecast of $2200/oz with the timing as expected as Gold preempts a Fed rate cutting cycle, while Central Bank and physical demand remains relentless.”

They noted that one of their bull cases was based on “Asian or CB physical demand being stronger than expected” and this “has played out (earlier than expected) and is the game changing development behind higher [price] floors.”

Among the factors that did not align with their original forecasts were interest rate cuts being pushed further back while the U.S. economy continued to outperform. “We also expected an underinvested investor community to subscribe in a meaningful way and drive the price rerating which has not been the case (so far),” they said. “We did not expect the emergence of an accelerated physical purchasing program” driven by runaway Chinese demand, which has propelled “shallower dips and a persistent rally that has not been short-lived as in the past 4 peaks seen post-COVID.”

They also pointed out that “both producer-related and secondary supply has not reengaged (as expected) at price peaks, and that lack of structural selling has allowed Gold to float higher.”

The updated forecasts now have gold averaging $2,200 per ounce in 2024, with a new higher floor of $2,000. “We also now expect Gold to print bull market gains in 2024 that is emblematic of past rate cutting cycles; that equates to $2475/oz (and almost $2600/oz if one accounts for the annual cost of carry,” they wrote.

Among the risks to their updated bullish forecasts, MKS Pamp notes that now everyone is bullish. “Banks are revising up forecasts and consensus for Gold has shifted in one direction,” they said, but offered the caveat that market positioning is not yet reflecting this. “Western investor positioning still remains underweight on a long-term historical Gold basis, vs the liquidity & holdings in other asset classes and commodities remain undersubscribed as an asset class.”

Other threats include “large Gold holders (including Central Banks) monetizing Gold if 1) they are forced to (eg: the financing of hot & cold wars), 2) Gold loses appeal as a geopolitical or inflation hedge and/or 3) Gold comes under direct sanction and policy risk,” as well as the potential for “strong secondary physical sales from retail coin & bar holders, globally, which has not been ignited.”

Turning to silver, the analysts wrote that a sweet spot is beginning to emerge, but investor demand must increase to get it there.

“Silver continues to have an attractive micro/fundamental story heading into a collective Central Bank rate cutting cycle (as is the case with Copper and to a lesser degree Platinum),” they said. “The market understands the structural supply challenges in these cyclical transition metals, but the demand story isn’t materializing the way bulls think it should, including investment demand which remains static.”

The analysts acknowledged that investors don’t have the patience to eat monthly losses as they wait for moves in a high interest rate environment, which helps to explain why silver and the PGMs are so under owned, but supply constraints will still push prices higher.

“Silver moved into a structural deficit in 2021 driven largely by energy-related industry demand (PV, auto etc) and has posted deficits averaging ~250mn oz the past 3 years including 2024,” they wrote. “While above ground stocks have managed to fulfill those annual deficits, known inventories – the free float – is back down near cyclical lows. The case for a ‘gradually then suddenly’ setup is developing and thus we marginally hike our already quite bullish forecast ($25/oz) to $25.50 and expect the Gold/Silver ratio to trade toward the lower end (~86) of its YTD range.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link