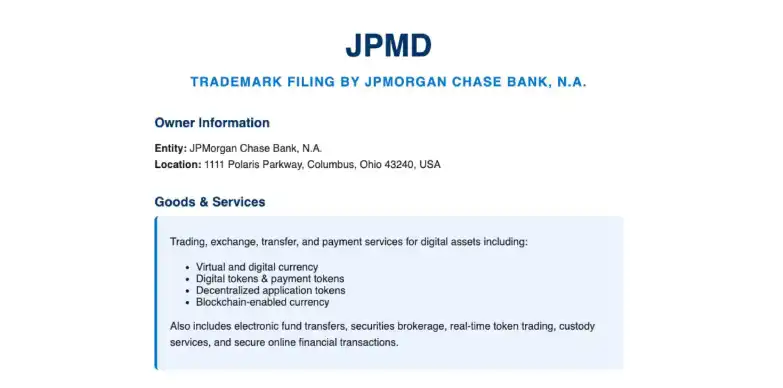

JPMorgan Chase has filed a trademark application for “JPMD,” which has sparked rumors that it may be preparing to launch a new USD-backed stablecoin, called the J.P. Morgan Dollar. According to the filing, the service would cover a broad range of digital asset activities, including trading, exchange, payments, custody, and fund transfers.

JPMorgan is Ready with a Stablecoin Plan

JP Morgan files for trademark “JPMD” speculated as JPMorganDollar – their intended new StableCoin.#JPMorgan #StableCoin pic.twitter.com/HMYHSYSrm8

— MartyParty (@martypartymusic) June 16, 2025

The move marks another major shift in JPMorgan’s evolving stance on cryptocurrencies. Although CEO Jamie Dimon has long expressed skepticism, recently labeling Bitcoin a “Ponzi scheme” with no intrinsic value. However, the bank has gradually embraced crypto. It now allows clients to buy Bitcoin and has started accepting crypto-based ETFs as collateral for loans.

If JPMD does emerge as a full-fledged stablecoin, it would signify a deeper commitment to digital assets from one of Wall Street’s most influential players. The rumored stablecoin could help JPMorgan compete with native crypto issuers like Tether and Circle, and may serve as a tool for faster domestic and cross-border payments—a strategy reportedly gaining traction among major US banks.

The trademark filing comes at a pivotal time for the U.S. stablecoin sector. Just last week, the Senate advanced the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act with bipartisan support. When the bill is passed, it would put in place a regulatory framework for stablecoin issuers and could be signed into law by President Donald Trump.

The current stablecoin market is valued at over $251 billion, and is led by Tether (USDT) and Circle’s USDC, according to DefiLlama. As a result of this, several firms and centralized entities are quickly steering their attention towards stablecoin.

This rapid growth hasn’t gone unnoticed. More and more companies, and even traditional banks, are turning their attention toward stablecoins.

Banks like Bank of America, Citi, and Wells Fargo are reportedly considering collaborative digital currency projects. When it comes to corporates, retail firms such as Walmart and Amazon are also considering launching their own private tokens, signaling that stablecoins are becoming an indispensable part of the digital finance strategies.

Governments are taking action too. South Korea and Hong Kong, in particular, are doubling down on their regulatory frameworks. Just yesterday, Hong Kong’s Financial Secretary Paul Chan Mo-po announced that the Hong Kong Monetary Authority (HKMA) will accelerate licensing for stablecoin issuers once the upcoming “Stablecoin Ordinance” takes effect.

Meanwhile, South Korea is pressing forward with the “Digital Asset Basic Act.” This legislation aims to provide a clear legal foundation for stablecoins. A related bill is currently under review in the National Assembly for regulation of stablecoin pegged to the Korean won or the US dollar.

Credit: Source link