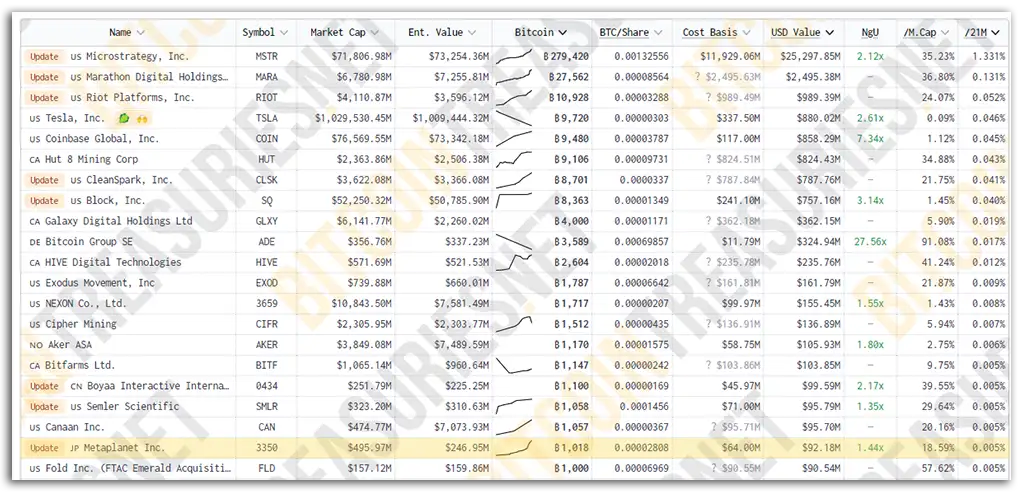

Metaplanet, a bold player in Japan’s investment scene, is making waves. With 1,018 Bitcoin worth $92.18 million, it’s now Asia’s second-largest corporate Bitcoin holder. That’s 0.005% of the total Bitcoin supply—pretty impressive. But why put so much into such a volatile asset? The answer lies in Japan’s economic troubles. A weakening yen, sky-high government debt, and low-interest rates have forced businesses to get creative. For Metaplanet, Bitcoin isn’t just an asset—it’s a shield against economic uncertainty. Since April 2024, the company has treated Bitcoin as its main treasury reserve.

This wasn’t an overnight move. In April, Metaplanet bought its first 117.7 BTC for $7.19 million. A few months later, it borrowed $6.8 million from MMXX Ventures to keep buying. The momentum didn’t stop there. In October, the company snagged another 156 BTC for $10 million. Now, Bitcoin accounts for nearly 19% of Metaplanet’s total market value. That’s not just strategy—it’s commitment.

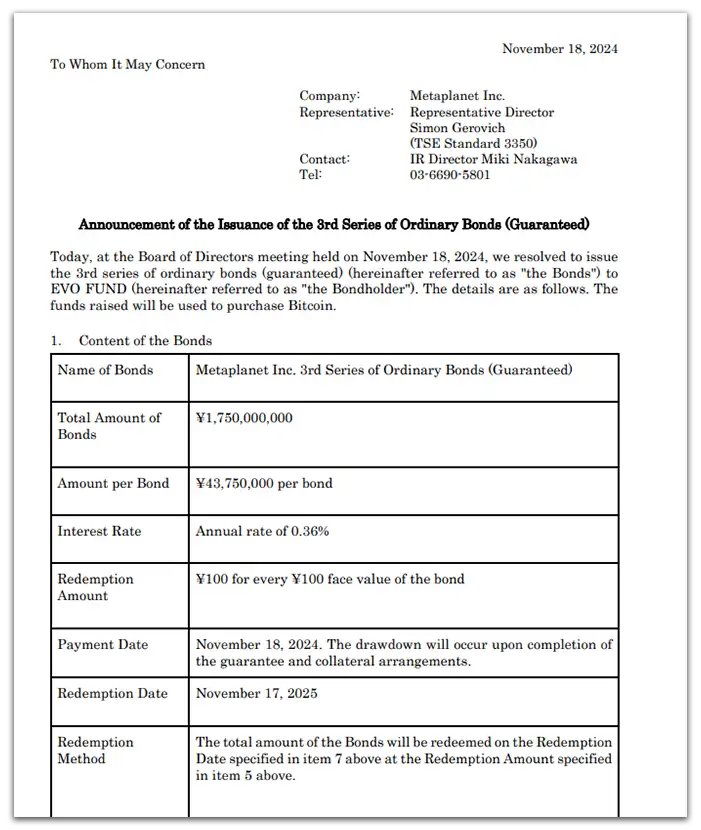

¥1.75 Billion Bonds

Today, Metaplanet stepped things up. It announced issuing ¥1.75 billion ($11.8 million) in bonds at a super-low 0.36% interest rate. The goal? To buy even more Bitcoin. Every single bond was scooped up by EVO FUND, showing investors are on board with this risky but exciting plan.

According to the announcement document by Metaplanet, there is no direct collateral against this bond issurance. However, they have placed a first priority mortgage on the land and building of Hotel Royal Oak Gotanda under the guaranteed contract. This hotel is owned by Metaplanet’s subsidiary Wen Tokyo Inc.

What to Expect

Metaplanet’s Bitcoin journey is far from over. Will its growing stash help the company weather Japan’s economic challenges, or will market volatility throw a wrench in the plan?

For now, Metaplanet is betting big on Bitcoin, and the stakes couldn’t be higher. Whether it wins or loses, one thing’s clear: this is a story to watch.

Credit: Source link