Lemon_tm

With Gold on an absolute tear as of late, many are perplexed by the gold miner stock side. Why aren’t they moving more aggressively higher? Part of the reason has to do with Oil, and high Oil prices hurt mining margins. Having said that, I fully expect gold miner stocks to begin a solid run higher here given valuations and sentiment improvement.

Considering an investment in the gold mining sector? The Sprott Junior Gold Miners ETF (NYSEARCA:SGDJ) could be a valuable addition to your portfolio. This ETF is engineered to mirror the performance of the Solactive Junior Gold Miners Custom Factors Index (SOLJGMFT), minus the usual fees and expenses. The goal of the index is to reflect the results of small-cap gold mining companies that are publicly traded on various regulated stock exchanges.

With a clear and systematic approach, the index that SGDJ follows selects stocks of junior gold companies that have a market capitalization ranging from $200 million to $2 billion. It highlights those junior gold mining firms that are expanding their revenue most rapidly, as well as exploration companies that are experiencing strong momentum in their stock prices. To ensure the index remains up-to-date with current market conditions, it undergoes a rebalancing twice a year, in May and November. During this process, the most recent factor scores are utilized to adjust the index’s composition and weightings, keeping the ETF aligned with the most promising junior gold mining opportunities.

SGDJ’s Holdings: A Closer Look

SGDJ currently has 45 stocks, with the total market capitalization of these holdings amounting to approximately $35.4 billion. The largest market capitalization of an individual holding is about $1.5 billion, while the smallest is around $168 million. The weighted average company market capitalization was roughly $995 million. The expense ratio for the fund 0.50%, which isn’t bad for the niche it’s investing in.

SGDJ’s portfolio does not include any large-cap stocks (>$10B). All the holdings are small-cap stocks (<$2B), which make up 100% of the portfolio. This is a unique feature of SGDJ, as it provides investors with pure exposure to the junior gold mining sector.

The top five holdings of SGDJ, as of December 31, 2023, were:

- Perseus Mining Limited: An Australia-based company engaged in gold mining and exploration activities in West Africa.

- De Grey Mining Limited: An Australian gold exploration company focused on the development of its Mallina Gold Project in the Pilbara region of Western Australia.

- Centamin plc: A mineral exploration, development, and mining company that specializes in exploring, mining, and processing gold in Egypt.

- Gold Road Resources Limited: An Australian gold producer focused on the exploration and development of the Yamarna Greenstone Belt in Western Australia.

- Bellevue Gold Limited: An Australian gold exploration company that operates the Bellevue Gold Project in Western Australia.

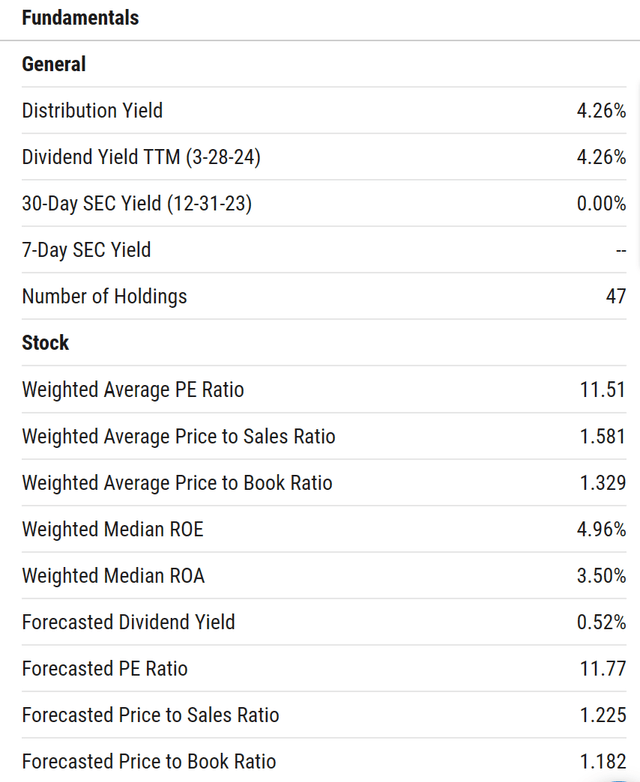

It’s worth noting that fundamentally speaking, the fund is relatively cheap. The Weighted Average P/E is 11.51 for example, and Price to Book at 1.32 makes this compelling.

ycharts.com

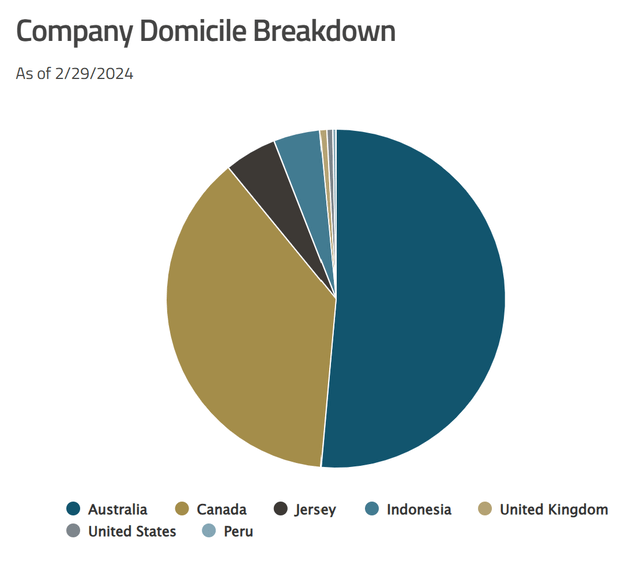

The majority of the fund is exposed to Australia and Canada at 51.4% and 37.7% respectively. Worth considering as it does mean buying this adds global diversification to a portfolio.

sprottetfs.com

Comparison with Peer ETFs

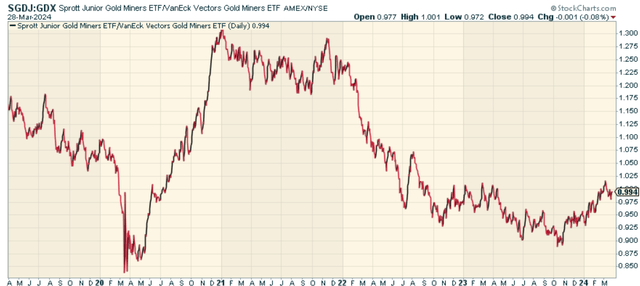

One peer ETFs to compare SGDJ against is the VanEck Vectors Gold Miners ETF (GDX). SGDJ primarily targets junior gold miners, which are smaller companies with potentially higher growth prospects and correspondingly higher risks due to their nascent stage of development. In contrast, GDX invests in more established, larger gold mining companies, offering investors a more stable but potentially less growth-oriented portfolio. Both ETFs differ in their tracking strategies and market exposure; SGDJ follows a rules-based index to replicate junior miners’ performance, while GDX tracks a diversified index of global gold mining firms, leading to variations in volatility and potential returns. When we look at the price ratio of SGDJ to GDX, it does look like relative momentum favors SGDJ.

stockcharts.com

The Pros and Cons of Investing in SGDJ

Investing in SGDJ comes with both advantages and potential drawbacks. On the positive side, the fund provides exposure to a sector that could benefit from favorable macroeconomic trends, such as a rise in gold prices. Furthermore, the fund’s focus on small-cap stocks offers potential for high returns, particularly during periods of strong gold price performance.

On the downside, investing in junior gold mining companies can be risky. These companies are typically more volatile than larger, more established mining firms. Additionally, they are often more susceptible to fluctuations in the price of gold and other macroeconomic factors, as well as Oil.

Conclusion: Should You Invest in SGDJ?

Some would prefer to get access to Gold directly through Gold ETFs of physical purchases, but for those looking for the stock side, the Sprott Junior Gold Miners ETF is a good fund for what it does.

However, potential investors should carefully consider the fund’s risks, including its exposure to volatile junior mining companies and susceptibility to fluctuations in gold prices. As with any investment, a thorough understanding of the fund and its underlying assets is essential before making an investment decision.

Credit: Source link