Solana (SOL), the world’s fifth-largest cryptocurrency by market cap, failed to hold strong and is now poised for a price drop. The current market sentiment appears bearish, with major assets experiencing notable declines. SOL has also broken below its crucial support level of $180.

Solana (SOL) Price Action and Upcoming Level

According to expert technical analysis, SOL has been gaining support from this crucial level since November 2024 and has tested it multiple times.

However, this time, as the asset fails to sustain, it loses this key level and closes a daily candle below $180, partially confirming a bearish move ahead. Based on recent price action and historical patterns, there is a strong possibility that SOL could witness a 15% price drop, reaching the $155 level in the coming days.

$115 Million Worth SOL Outflow

Following this notable breakdown, investors and long-term holders have been accumulating SOL tokens, as reported by the on-chain analytics firm Coinglass. Data from spot inflow and outflow reveal that exchanges have witnessed a significant outflow of $115 million worth of the asset, indicating potential accumulation.

In this bearish market trend, such outflows can create buying pressure and potentially lead to a price rebound.

However, intraday traders appear to be following long-term holders, as they seem to be betting on the long side.

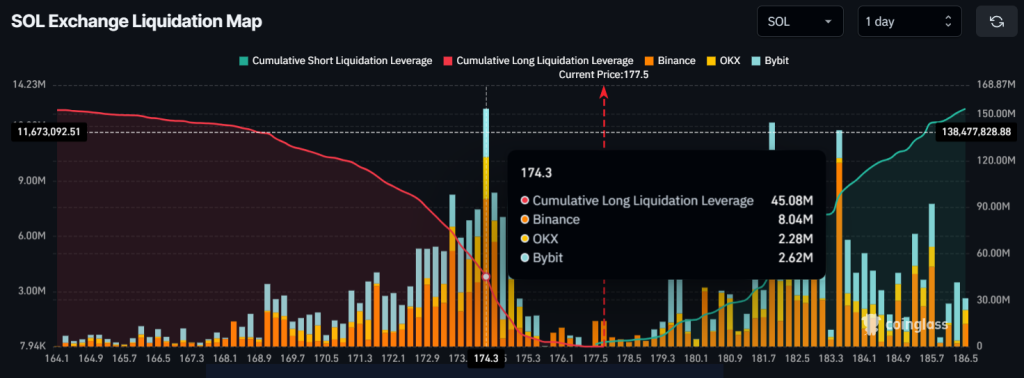

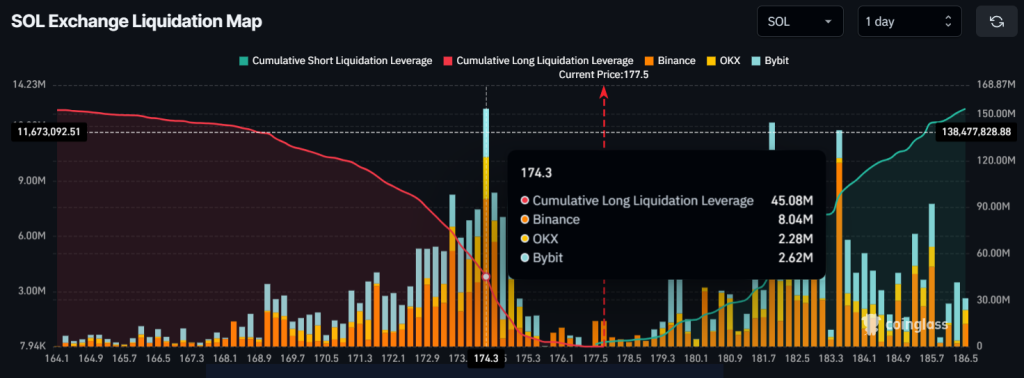

$45 Million Worth Long Bet

Data shows that traders holding long positions are strongly dominating the asset and are over-leveraged at $174.3, with $45 million worth of long positions. With such significant open positions, this level acts as a crucial support.

Conversely, $180 is another key level where traders holding short positions are over-leveraged, with $15.50 million worth of short positions. This suggests that short sellers are exhausted, which could help bulls reclaim the lost support level.

Current Price Momentum

SOL is currently trading near $177 and has experienced a 6% price drop in the past 24 hours. During the same period, its trading volume surged by 110%, indicating heightened participation from traders and investors amid the price decline.

Credit: Source link