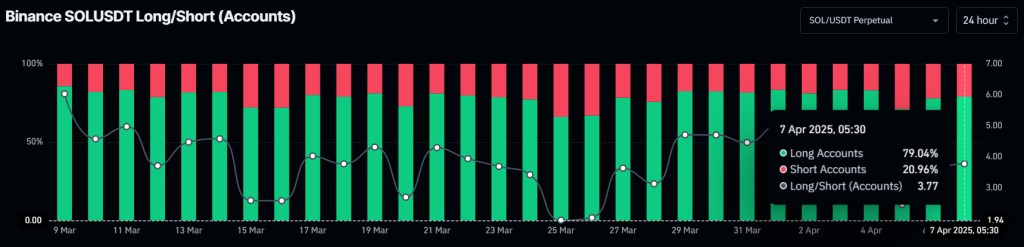

Solana (SOL), the world’s sixth-largest cryptocurrency by market cap, is gaining massive attention from Binance traders. Recently, data from the on-chain analytics firm Coinglass revealed that 79% of top traders on Binance are going long on SOL, despite the bearish market sentiment.

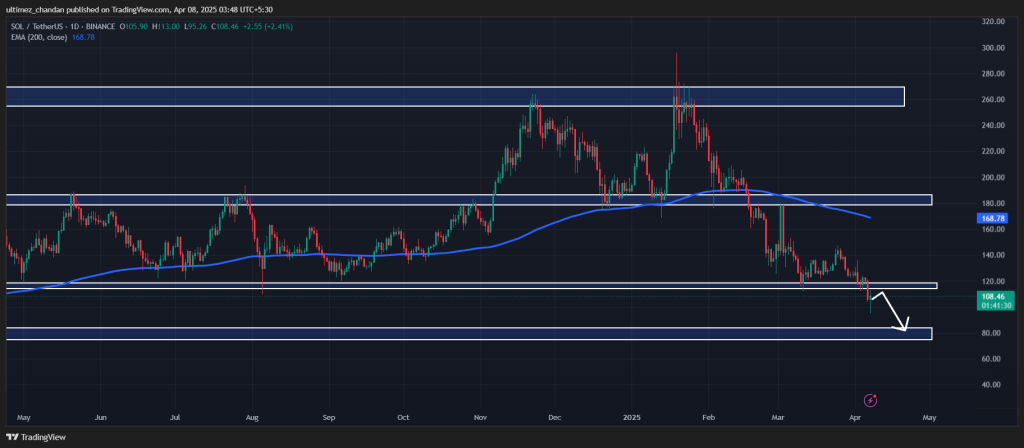

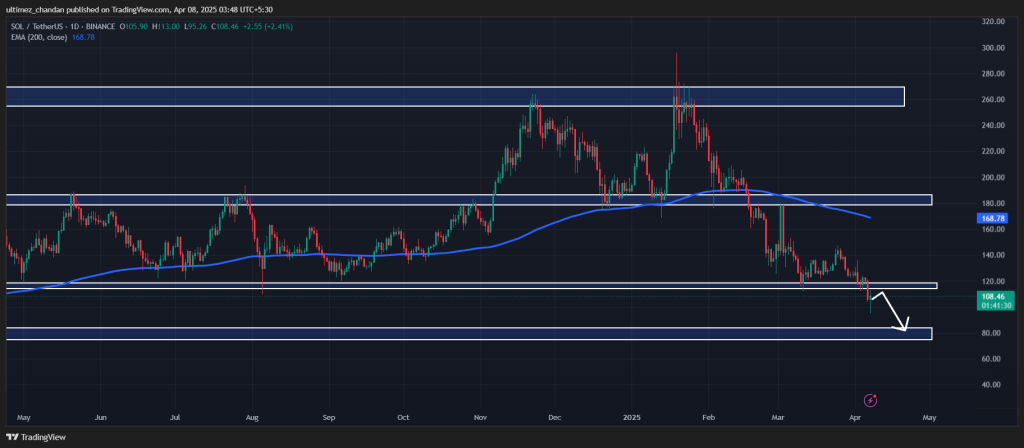

Solana (SOL) Price Action and Upcoming Levels

According to expert technical analysis, SOL appears bearish despite the ongoing price recovery. On April 6, 2025, SOL broke down from its prolonged key support level of $115 and also closed a daily candle below that level, a level it had held since March 2024.

This breakdown has pushed SOL into an extremely bearish phase. However, the ongoing price recovery appears to be a retest of the breakdown level.

Based on the recent price action and historical momentum, if SOL remains below the $115 level, there is a strong possibility it could decline by 30% and reach the $77 level in the near future.

This bearish outlook is strongly supported by momentum indicators such as the Relative Strength Index (RSI) and the 200-day Exponential Moving Average (EMA) on the daily time frame.

Current Price Momentum

As of writing, SOL was trading near $107 and had registered a price drop of over 1% in the past 24 hours. Meanwhile, the asset showed a strong recovery, having hit a low of $95.6 during the Asian market session. Amid this significant price fluctuation and market volatility, SOL’s trading volume has skyrocketed by 185% during the same period.

$140 Million Worth of SOL Outflow

While examining the on-chain metrics, it appears that whales, investors, and long-term holders have seized the opportunity to accumulate SOL at the current price level, according to the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges have seen an outflow of approximately $140 million worth of SOL over the past 24 hours. This substantial outflow suggests potential accumulation and could lead to buying pressure.

However, due to the prevailing bearish sentiment, a strong upside rally may be difficult to achieve.

Credit: Source link