Dubai top global market for ultra luxury home sales in 2023

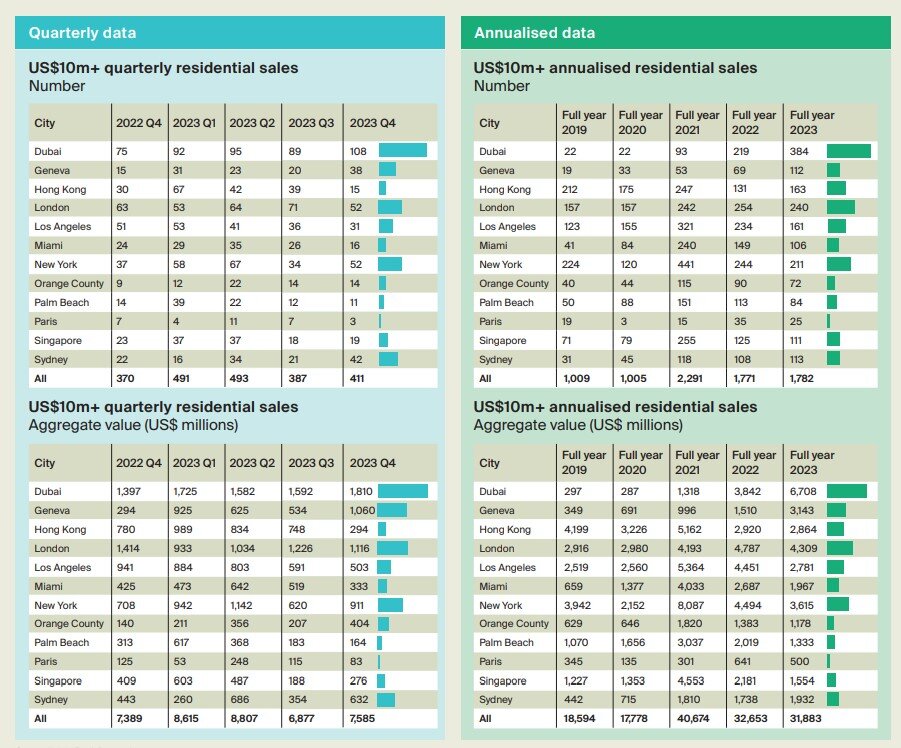

Based on new data from international property consultant Knight Frank, global super-prime ($10m+) residential sales rose 11% in Q4 2023 on a year-on-year basis. There were 411 sales across the 12 markets covered in the three months to December compared to 370 in the same period in 2022.

The uptick in super-prime sales activity reverses the slowdown in the previous quarter and reflects a more confident global economic outlook at the end of 2023, as expectations for interest rate cuts in 2024 grew stronger.

The largest market in Q4 was Dubai (108 sales), followed by London and New York (with 52 each). Hong Kong volumes dipped to 15 sales, pushing it out of the top five markets for the first time. Sydney and Geneva ranked fourth and fifth, respectively, with strong activity throughout the quarter.

Although super-prime sales rose in the fourth quarter, pushing 2023’s total sales ahead of 2022, they were still 22% lower than the levels reached in 2021. However, the total was still significantly higher than the pre-pandemic level seen in 2019.

The recently released Wealth Report 2024 noted that global wealth creation turned positive in 2023, with a 4.2% increase in the world’s Ultra-High-NetWorth-Individual (UHNWI) population. This growth was driven by changing expectations around interest rates and supported by the US economy and a strong recovery in equity markets. Annualized $10m+ sales have risen over recent quarters despite the impact of soaring interest rates on global housing markets.

Liam Bailey

The 1,782 sales in the 12 months to the end of December 2023 represented an increase of 1% compared to full-year 2022, but a 22% decrease from the peak of 2,291 sales in full-year 2021. The total value of super-prime sales reached $31.9 billion in the year ending December 2023. While this was a 22% decrease from the $40.7 billion peak during the 2021 pandemic property boom, it was still substantially higher than the pre-pandemic level in 2019.

Liam Bailey, Knight Frank’s Global Head of Research says, “2023 was a pivotal year for global super-prime markets, while rates continued to climb in the first half of the year, wealth creation rebounded as asset prices surged on the back of the AI -fuelled equity boom, which was then supported in the final quarter by expectations of lower rates. 2024 is likely to be defined by the eventual pivot to lower debt costs which will boost activity in key global super-prime markets.”

Local Luxury Property Market Activity in 2023

Dubai’s market continues to deliver strong sales volumes in the super-prime market. Significant price growth over the past two years has seen luxury prices increase by well over 100%, shifting many properties from the prime to the super-prime segment. Demand now extends beyond waterfront properties to inland villas confirming a widening of the market.

Despite a challenging economic backdrop London has for the second quarter retained the second spot in our list, albeit sharing the position with New York. Super-prime sales in the city stumbled at the beginning of 2023 – following the infamous “mini-budget” fiscal event that spooked lending markets and led to a more challenging sales environment.

Geneva’s positive performance reflects an uptick in Switzerland’s wealth landscape. According to Knight Frank’s Wealth Report 2024, Switzerland’s UHNWI population grew by 5.2% in 2023, the fifth strongest globally and the highest in Europe.

In Australia, the luxury real estate market is gaining momentum due to a combination of strengthening buyer sentiment and shift in outlook around interest rates. Wealth creation in Australia is also supporting the market – with a notable rise in cash transactions, which now represent over half of all prime property sales in Sydney.

New York saw an increase in sales volumes in Q4 in part due to the launch of new luxury developments, pointing to confidence in the market. Conversely, Miami is facing a shortage of super-prime properties, limiting sales despite high demand. Los Angeles, however, continues to see relatively healthy sales volumes, despite some uncertainty for buyers from the state’s mansion tax.

Singapore’s super-prime market continues to grapple with more stringent purchase taxes, escalating to 60% for foreign buyers. Hong Kong’s weak Q4 in the super-prime market was reflected in the wider residential sales market – prompting the authorities to make substantial changes to property taxes in February this year.

Real Estate Listings Showcase

Credit: Source link