The spot price of gold has hit all-time highs, helping to drive up the share price of gold development and mining companies like Seabridge Gold (NYSE:SA). SA shares are up roughly 25% year-to-date. At current valuation levels, investors looking to speculate on the price of gold would do better to look elsewhere.

Value is in the Ground

Seabridge Gold specializes in acquiring and developing gold properties, aiming to offer shareholders substantial leverage to a rise in gold price. While its primary focus is gold exploration, Seabridge has also made significant copper discoveries.

The company’s primary focus is expanding its mineral resources through exploration rather than going into production independently. Interestingly, Seabridge adopts a business model that entails selling projects or entering into joint ventures for production with prominent mining companies.

Since its establishment in 1999, Seabridge Gold has acquired interest in several advanced-stage gold projects across North America. Critical undertakings include the KSM property in British Columbia, the Courageous Lake property in the Northwest Territories, the Iskut Project in British Columbia, the 3 Aces Project in Yukon, and the Snowstorm Project in Nevada.

Seabridge Gold’s Recent Financials

Seabridge recorded a net loss of $29.3 million, or $0.35 per share, for the year ended December 31, 2023, a substantial increase compared to the net loss of $7.4 million or $0.09 per share in the previous year. The negative performance was primarily attributable to a non-cash loss from the remeasurement of its Secured Note liabilities.

The company does not generate cash inflows from its operations, so it relies on external financing to fund exploration projects and ongoing activities. Management has employed an at-the-market (ATM) offering as a significant funding source, allowing the issuance of up to $100 million of its common shares. It managed to raise $42.8 million in 2023 and $11.0 million post the year-end. As of December 31, 2023, the ATM offering still has room for a further $67.6 million.

Seabridge Gold aims to fully leverage the ATM offering, confident that it, along with the working capital of $54.5 million, will ensure enough liquidity to sustain operations and meet commitments for the upcoming year.

It is also exploring various alternative financing options to meet its operational costs and established targets. Potential options include issuing debt or selling shares, financing under a Prospectus Supplement to its existing Base Shelf Prospectus, selling shares through its ATM program, selling a royalty or streaming interest in the KSM Project, receiving funding from a joint venture partner or selling interest in one of the company’s other projects (which was a primary goal for 2023 that went unmet).

Almost all options immediately available to the company will dilute current shareholders.

Is SA a Buy, Hold, or Sell?

Seabridge Gold stock has been on an upward trend and currently sits towards the top of the 52-week range of $9.31-$16.18. It demonstrates positive price momentum trading above the 20-day (12.54) and 50-day (11.83) moving averages.

The recent run in price has pushed SA stock into fair-to-rich valuation territory. The P/B ratio of 2.3x sits above the Basic Materials sector average of 1.4x and the Gold industry average of 1.4x.

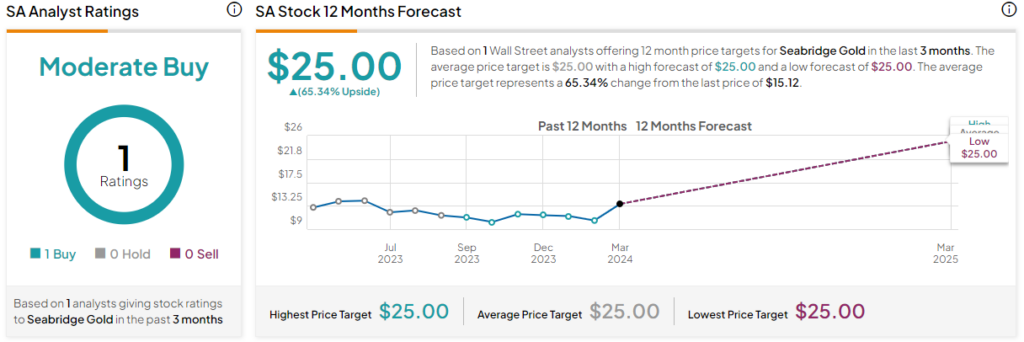

The company is thinly followed by Wall Street, but based on the most recent rating and price target assigned by one analyst in the past three months, the stock is rated a Moderate Buy. The average price target for SA stock is $25, representing a 65.34% upside from current levels.

Final Thoughts on Seabridge Gold

Seabridge offers its shareholders enticing leverage against the backdrop of escalating gold prices. It also champions a business model that favors ardent exploration and joint ventures over independent production. However, this leaves it at risk of not finding a suitable mining partner (something it’s struggling with currently) before running out of capital.

Investors considering this golden opportunity should also weigh the potential for shareholder dilution against the prospects of rising gold prices. There are likely better options for investors to pursue.

Disclosure

Credit: Source link