Gold prices are well-positioned to make further gains this year due to ongoing economic and political uncertainties, while the same factors are set to hold silver back, according to the latest commodities analysis from StoneX Bullion.

“When we last wrote, the FOMC had completed its December meeting and as we noted at the time ‘the markets took the outcome of the Federal Open Market Committee’s final meeting of 2023 as (again) postulating an easier rate prognosis than is likely to be the case,’” they wrote. “Now we have had the Minutes of that meeting and as usual the devil is in the detail.”

The analysts noted that the minutes contained negative observations about the economy which were positive news for gold investors, such as “slowing growth of labour income and increased use of credit may contribute to softer consumer spending. Delinquency rates are rising for many types of consumer loans…. And in addition, some small businesses are already seeing tighter credit conditions and increasing delinquencies.”

“This talks to the argument about banking risk, which has been a persistent cause of concern for this writer, at least, and continues to be a potential support for gold – think back to how gold came to life in March-May last year when we had banking ‘crises’, even though the Fed and the Swiss National Bank were fleet of foot in addressing the problems,” the analyst said. “While the rate is seen as at or near its peak the Committee is not ruling out any further firming if warranted by ‘the totality of incoming data the evolving outlook, and the balance of risks.’”

The Fed minutes, when taken together with the nonfarm payrolls data from late last week, lead StoneX to believe that “employment continues to increase in the manufacturing sector and economic growth is still expanding, albeit at a slower rate than previously. So on that basis there is a considerable degree of uncertainty swirling through the outlook for the US economy and that too is extended into Europe while the Chinese economy is still not out of the woods.”

All of this ambiguity is creating a positive environment for the appreciation of gold prices, StoneX said.

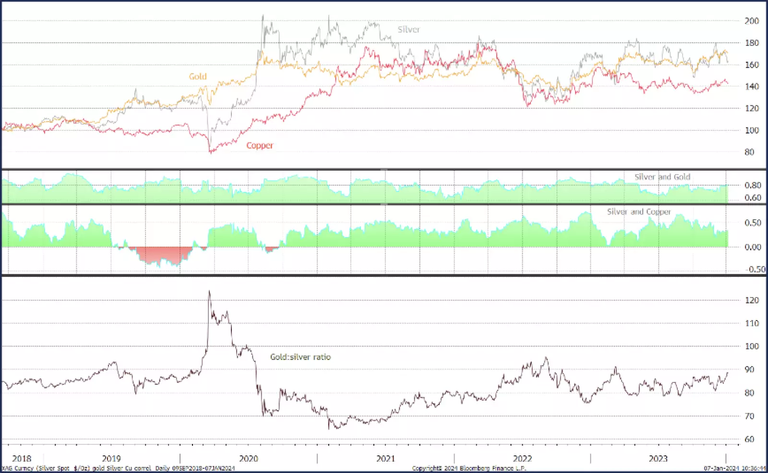

“Gold tends to thrive on uncertainty (and of course we must not forget geopolitics, which are currently supportive and on a humanitarian basis we must hope that that goes into reverse), and this implies that the outlook for gold prices remains positive,” they wrote. “For silver, in principle a bullish gold outlook should theoretically imply an ever more bullish silver prognosis, but at present the economic uncertainties are keeping silver comparatively subdued and the ratio between the two may be more likely to expand in the next few months than to contract.”

Gold silver and the ratio; silver’s correlation with gold and with copper (Source: Bloomberg, StoneX)

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link