The U.S. election race is getting tighter. Kamala Harris is gaining on Donald Trump on Polymarket, a blockchain-based betting platform. This shift has sparked interest. Let’s see why this is happening and what it could mean for the upcoming election.

Betting Trends Show Trump Losing Momentum

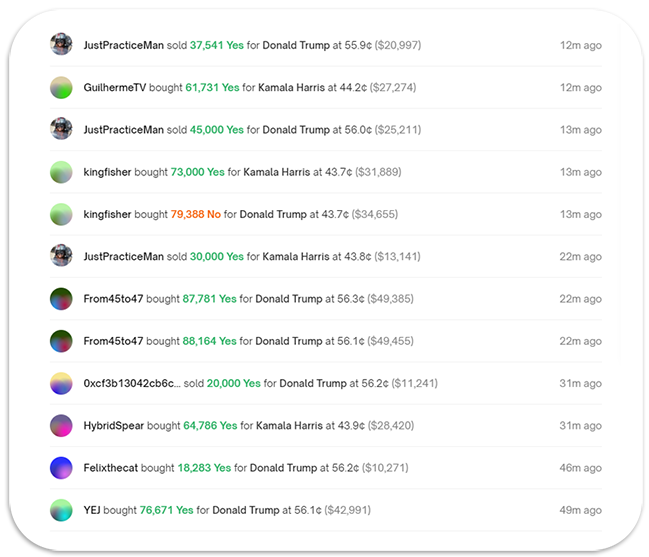

Polymarket has seen a jump in activity. Bettors have shifted their predictions. Harris’ shares went up from 33 cents to over 44 cents at the end of October. In the same period, Trump’s shares dropped from 66 cents to 55 cents. This shows growing market confidence in Harris.

Polymarket users buy shares based on potential outcomes. The current odds reflect a major change in sentiment. These shifts weren’t just from small bets either. People have placed big bets, some over $10,000, even reaching $100,000. These high-value bets hint at strong interest and belief in Harris’ chances.

Big Players Make Strategic Moves

Large holders of shares have started selling to meet high demand. They’re not just betting on a win—they’re managing risk. Traders are hedging their positions, aiming to stay secure whether Trump wins or loses. Analysts note that this isn’t random. It’s a calculated move, looking at past trends and possible results.

Reports of voting issues and social media buzz also play a role. Rumors can sway public opinion. These stories create uncertainty, affecting betting behavior.

What to Expect

Harris’ recent climb could link to insights from past elections. In 2020, poll results didn’t fully match voter behavior. Biden’s approval ratings were low, yet Republicans didn’t make big gains. This suggests polls may not capture real voter sentiment.

Political bettor ‘Domer’ shared on social media that they see Harris’ chances at 55-60%. They believe polls don’t always reflect shifting voter trends. Early voting data shows strong Republican turnout, hinting at new strategies.

With election day approaching, traders will keep adjusting their tactics. Will Harris keep closing the gap, or will Trump pull ahead again?

Credit: Source link