The U.S. Federal Reserve (FED) has just called an emergency meeting as global markets are in total chaos right now. The big guess is that they’ll cut interest rates by 50 basis points. This could be a huge move to stop the financial mess.

In just a week, the Japanese yen has crashed by 13%. Meanwhile, Korea and Taiwan’s currencies have dropped by 10% each. Bitcoin isn’t doing any better – it’s down by a shocking 21%! Even S&P futures are down by 4%. The big reason? Japan’s cash and carry trade has flipped, causing major panic across markets.

With the Fed meeting coming up, everyone’s betting on a 0.5% rate cut in September. This move might give some relief, but there’s a catch. Economist Peter Schiff warns that lowering rates could actually push the U.S. into a recession. So, it’s a double-edged sword.

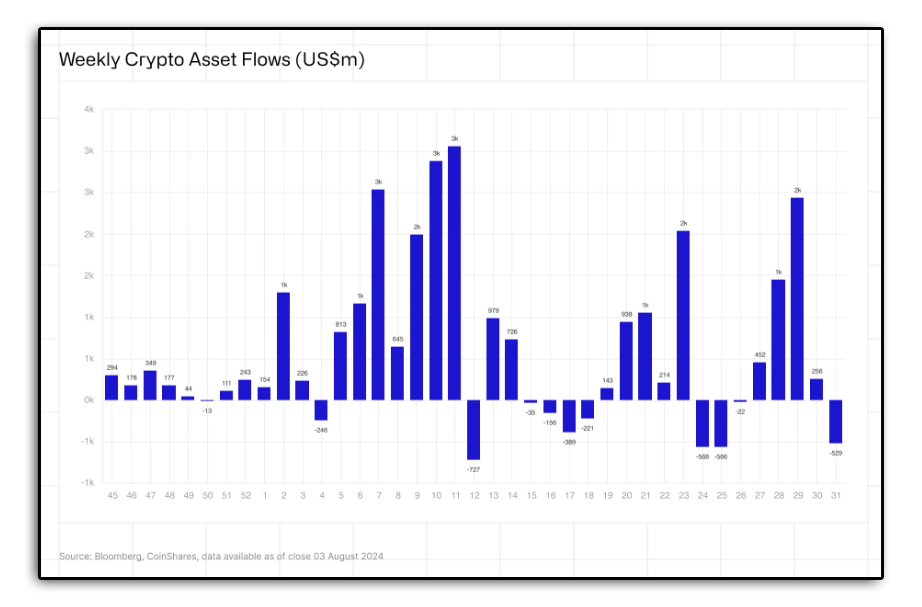

Crypto Meltdown: $529 Million Flees Digital Assets!

The crypto world is also in trouble. CoinShares reports that institutional investors pulled out a jaw-dropping $529 million from crypto products last week. This is the first time in four weeks that we’re seeing such massive outflows. The fear of a U.S. recession and other market issues are driving this panic.

Breaking it down: the U.S. led with $531 million in outflows. Germany and Hong Kong also saw $12 million and $27 million in outflows, respectively. On the bright side, Canada and Switzerland saw inflows of $17 million and $28 million. But the crypto market is still hurting badly. Bitcoin saw $400 million in outflows, and Ethereum suffered $146 million in redemptions. Ethereum’s year-to-date outflows have now hit $430 million!

But wait, there’s a silver lining. CoinShares notes that newly launched U.S. ETFs saw $430 million in inflows. However, this is overshadowed by $603 million outflows from Grayscale trust. European ETPs also had some minor outflows.

Interestingly, multi-asset crypto funds had $18.1 million in inflows. XRP and Litecoin saw small gains too – $0.4 million and $0.2 million, respectively. As the market keeps changing, these updates are crucial for anyone watching the financial and crypto worlds closely.

Credit: Source link