“Based on what I have observed with some of the top collectors/scholars, the pursuit of knowledge and the desire to know more helped them to build their dream collection,” explains Ho Zi-yong, head of sales, watches, at Phillips Asia. “They learn and refine their knowledge as they progress, allowing them to articulate [build foresight] and hopefully accurately acquire important timepieces.”

“We make a big distinction between investors and collectors,” explains professional watch expert and founder of The Watch Fund, Dominic Khoo. “Investors in a commodities fund don’t really care for barrels of oil or coffee beans – and hardcore watch lovers don’t really care for 20 per cent returns.”

STYLE Edit: How Breitling shaped the history of watches

STYLE Edit: How Breitling shaped the history of watches

According to Khoo, the most important thing to take into account when dipping your toes into investing in the high-end watch market is to know who you are and be truthful with your intentions. The key is having an honest conversation with yourself: do you really want to build your timepiece portfolio, or do you just want to invest in a personal accessory that you might consider selling down the road?

“Serious investors are only interested in two things: buying low and selling high,” explains Khoo. “Most guys would lie to themselves about the watches they bought emotionally being investments – and most don’t ever sell!”

Investing in a timepiece that will outperform the stock market means catering to watch aficionados and mainstream brands are hardly the only luxury marques on their radar. The key is to be brand agnostic – and do your research.

Organisers decide to take Watches and Wonders’ 2021 event entirely online

Organisers decide to take Watches and Wonders’ 2021 event entirely online

“With 600 watch brands out there, every brand has got good stuff for the price we’re paying,” explains Khoo. “At the same time, there’s also things on the other end of the spectrum. You have to look at each brand, model, piece, condition, serial number, provenance, price, and so on and so forth.”

So what does make for a smart investment? Investing in luxury goods means selecting brands and models that are considered recession-proof, with the key term here being uncorrelated assets. While most investments are directly affected by the economy, smart investors should be on the lookout for things that the super-rich still buy – recession or no recession.

Like an ETF or a mutual fund, there’s really no foolproof way to predict which watches to buy today to create a nest egg for tomorrow.

Think about it like this: if you buy a US$20,000 watch from a shop that sells it for that price and everyone else buys it for that price, too, you can only make money by hoping to sell it for US$22,000. Why would someone give you a US$2,000 profit on your scratched, second-hand watch when they could go back to the shop and buy it brand new for US$20,000? Short answer: they wouldn’t.

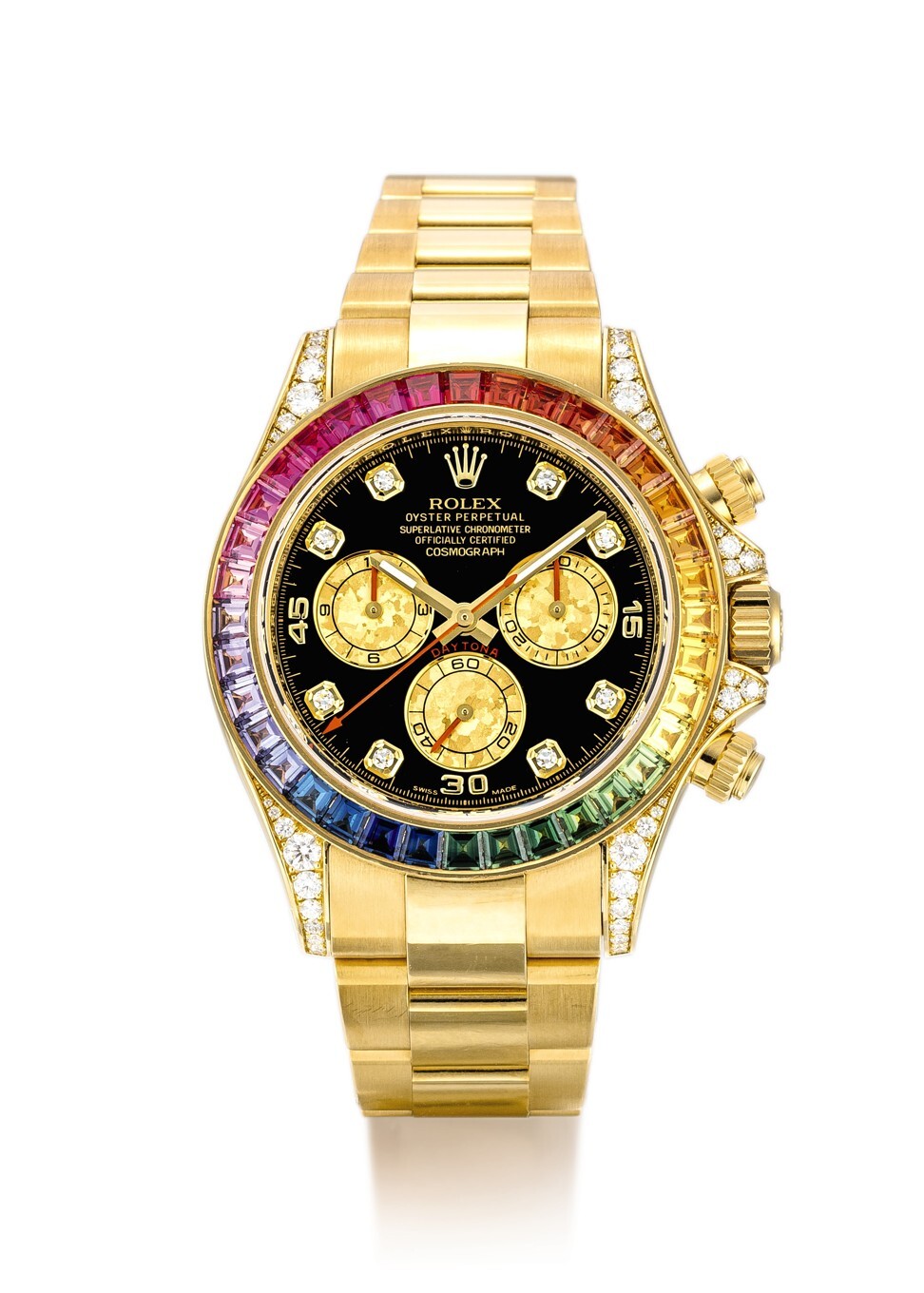

“There is only a small percentage of watches truly considered as investment grade timepieces and the lucky group of collectors who can source and own one or two pieces from this segment understands very clearly what they need … [which is] a constant build-up of knowledge to spot and understand,” adds Ho.

How Dash Living spread co-living in Hong Kong and Singapore despite Covid-19

How Dash Living spread co-living in Hong Kong and Singapore despite Covid-19

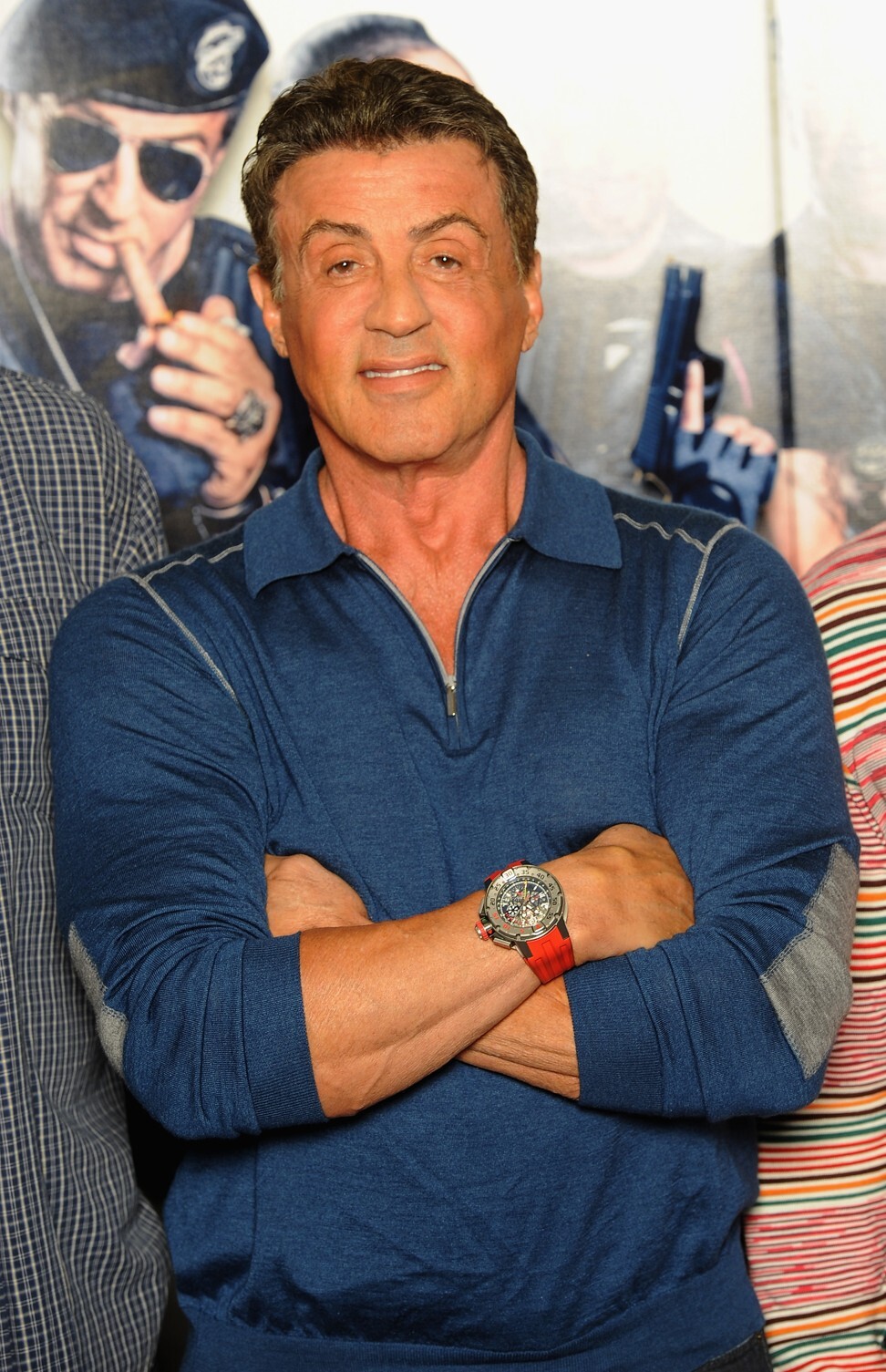

The only types of watches Khoo recommends seriously investing in would be either a watch that money cannot buy, or a watch you can buy at a price that no one else can get, which typically means an initial investment of anywhere from US$250,000 to over US$5 million.

Serious watch investing as a private individual (where you keep all the watches yourself) is a relatively new form of investing, and while it is technically possible to outperform the stock market or make a profit on your daily driver, if you’re serious about turning a profit by investing in watches, it is likely to require a million dollar investment, a portfolio manager and potentially locking your prized timepieces in a safety deposit box for the long haul.

“If you really love watches, go buy what you like from the shops and wake up each morning looking at your watch and grinning stupidly,” Khoo says. “[However], if you want to make watches an investment, be careful to find [an investment manager] that makes money only when you do.”

Want more stories like this? Sign up here. Follow STYLE on Facebook, Instagram, YouTube and Twitter .

Credit: Source link