Gold prices have started the week on the back foot after posting losses last week. Traders are certainly cautious when it comes to the gold price, as the data released on Friday gave them mixed signals. The question on their minds is: what will the Fed do next in light of the strong employment market, which was confirmed by the US NFP data, but continue the slowdown in the economic data, which we saw in the US ISM data?

Background

The gold price closed in positive territory on Friday as there was a real tug of war between the bulls and bears on the back of the data. The US NFP data printed a reading of 216K, while the expectations were for 170K, and the previous number was 199K. The US unemployment rate fell further to 3.7%, while the consensus was for 3.8%. The US labour data confirmed that the labour market is strong, and all of this triggered a serious sell-off in the gold price. But then, after a few hours, we had the US ISM Services PMI number, which fell short of expectations and printed a reading of 50.6, still in expansion territory as anything above 50 shows expansion, but fell short of forecast, where the reading stood at 52.5.

What Is Next?

The tug-of-war that is taking place between bulls and bears among gold traders is going to have more information on Thursday when the US CPI reading will be released. This is extremely important data, and the CPI numbers out of Europe have shown that inflation started to move in the wrong direction again, which has put more pressure on the European central bank. And traders in the US are thinking that a similar scenario can take place on Thursday if inflation fails to impress Wall Street. The forecast is for inflation to slightly tick higher to 3.2% from its reading of 3.1%; however, things would be highly volatile for the gold price if the number changes significantly from the base line as traders would then adopt a completely different approach. For instance, if the data shows a lower reading, we could see the gold price moving higher as the dollar index would move lower, and if the data shows a higher reading than 3.2%, we could see a significant drop in prices.

The Price Action

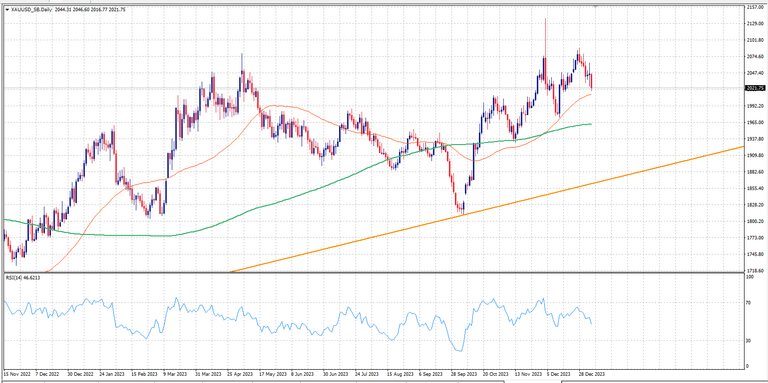

Between now and Thursday, gold prices are more likely to remain in limbo as the tug-of-war continues among gold traders. Most traders would be keeping an eye on the 50-day SMA, which could provide some support, but the main support continues to remain the 200-day SMA, which is shown in green. The price is likely to flirt with the 200-day SMA near the 1965 price mark if inflation comes out of the box; however, if the number suggests that things are still on track and they are improving, we could see the bargain hunters pushing the price level towards the 2074 price level.

Gold Trading chart by Exness

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Credit: Source link